CoT: Peek Into Future Through Futures, How Hedge Funds Are Positioned

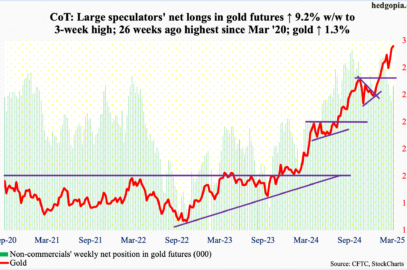

Following futures positions of non-commercials are as of April 8, 2025. 10-year note: Currently net short 1,078.5k, up 215.2k. Non-commercials raised net shorts in 10-year note futures by 24.9 percent this week to... READ MORE

Major Equity Indices Deeply Oversold, But Widespread Selling Yet To Show Signs Of Letup

Amid fears of tariffs-induced economic slowdown/contraction and indiscriminate selling of stocks, equity bulls are hoping for signs of stability and a relief rally. It has been 11 quarters since the US economy shrank.... READ MORE

CoT: Peek Into Future Through Futures, How Hedge Funds Are Positioned

Following futures positions of non-commercials are as of April 1, 2025. 10-year note: Currently net short 863.3k, up 53.2k. FOMC minutes for the March 18-19 meeting will be out Wednesday. The fed funds... READ MORE

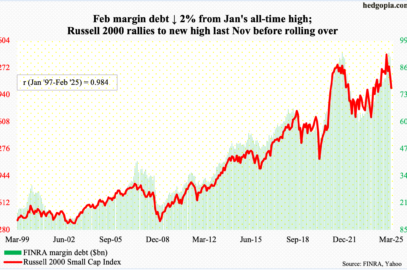

Amidst Corporate Buybacks And Margin Debt Dynamics, Equities Likely Headed Lower Toward This Month’s Must-Save Lows

Through 4Q24, buybacks continued to act as a tailwind, while margin debt fell in February from January’s fresh record. The latter in particular is at risk of continued downward pressure. At the end... READ MORE

CoT: Peek Into Future Through Futures, How Hedge Funds Are Positioned

Following futures positions of non-commercials are as of March 25, 2025. 10-year note: Currently net short 810.1k, down 71.3k. Non-commercials reduced net shorts in 10-year note futures sequentially, but holdings remain elevated. In... READ MORE

After Low-Double-Digit Declines From Feb Highs, Large-Cap Indices In Process Of Bottoming, At Least Near Term

After dropping by low double digits from their February all-time highs, the major large-cap equity indices are showing signs of a bottom – duration and magnitude notwithstanding. Between February 19th when the S&P... READ MORE

CoT: Peek Into Future Through Futures, How Hedge Funds Are Positioned

Following futures positions of non-commercials are as of March 18, 2025. 10-year note: Currently net short 881.4k, up 144.3k. As expected, the FOMC left the fed funds rate steady at a range of... READ MORE

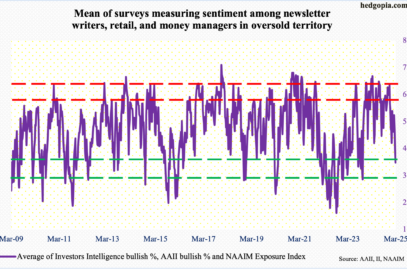

Under Pressure For Several Weeks, Equities Could Be Signaling A Relief Is Imminent

Equities have been under pressure the last several weeks. Investor sentiment has taken a beating. Amidst this came signs last Friday that a relief could be in the making. With the major equity... READ MORE