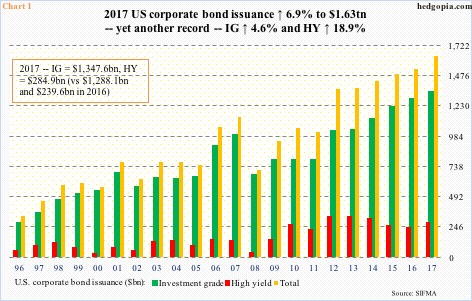

U.S. corporate bond issuance hit a new record last year. Issuance totaled $1.63 trillion, up 6.9 percent over 2016. This was the fastest growth rate in five years, and also the eighth consecutive year of trillion-plus issuance (Chart 1).

Investment-grade rose 4.6 percent in 2017 to $1.35 trillion, while high-yield surged 18.9 percent to $284.9 billion. This was the first time in four years that high-yield managed to grow, and quite a growth it put up.

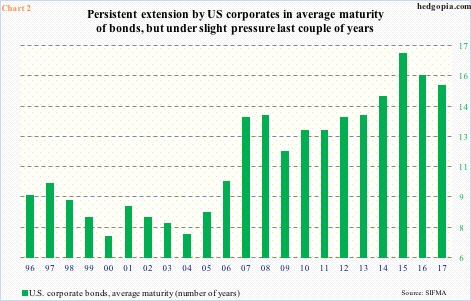

Since 2009, these corporations have issued $11.8 trillion. As massive as this amount is, they have also taken advantage of the prevailing low interest rates. Maturity extension in a low-rate environment helps. This is precisely what took place, with the average maturity having risen from 11.8 years in 2009 to 17 in 2015.

That said, the green bars in Chart 2 have shrunk the last two years, with 2017 at 15.3 years.

As time passes, these bonds eventually have to be paid off or refinanced.

The thing is, low rates would not last forever. The credit cycle comes with its usual ebbs and flows.

In this perspective, it is worth remembering that even though high-yield issuance put up such a good showing last year, the performance of high-yield bonds was anything but. JNK (SPDR Barclays high yield bond ETF) was merely up 0.7 percent – massively diverging with/underperforming equities in general. Year-to-date, it is up 0.5 percent, versus 3.5 percent for the S&P 500 index. In normal circumstances – with emphasis on the word normal – this tends not to bode well. On the monthly chart, JNK seems to be rolling over (not shown here).

Thanks for reading!