- Gold bears had big opportunity to push price lower on Monday

- Technicals acting better, except near-term conditions little overbought

- How hedge funds were reacting to Friday/Monday action will be a good tell

Monday, gold had a solid excuse to melt down. In fact, post-Swiss vote, the metal, along with silver, did exactly that in overseas trading. To refresh, the Swiss on Sunday overwhelmingly voted down an initiative requiring their central bank to hold 20 percent of assets in gold, among others. Last week, as the week progressed, polls were increasingly indicating that the gold referendum was headed for a defeat. The metal knew as much – sold off 2.6 percent on Friday. So once the Swiss news broke, gold came under more pressure. But then buyers showed up. The AM weakness was bought hand over fist. When it was all said and done, Monday closed up four percent! It was not just gold that day. The whole commodities complex attracted bids – oil and the rest. So, short-covering must have played a role in all this, gold including. Plus, momentum buyers piled in. But it is possible there is more to it than meets the eye.

It is always a good sign when buyers take a sell-off prompted by bad news as an opportunity to buy. Plus, as was explained previously, gold has been acting better technically. November was a doji month. Monday saw another engulfing candle – third in the past 16 sessions. The risk in the very near-term is that conditions are a little overbought. But not medium- to long-term. Just near-term. If prices do come under pressure in the next several days, a big tell would be if buyers once again show up near technically important levels. Then it is probably safe to assume that traders/investors are positioning for a better 2015. The 1180 level continues to hold importance (114.50ish on GLD).

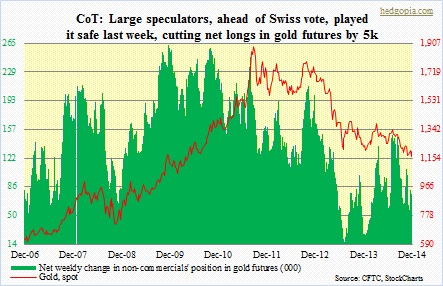

Another tell would be how in the futures pit large speculators were reacting to the roller-coaster pricing action the past three sessions. We will learn this Friday. Last week (as of Tuesday), they played it safe, by cutting net longs by another 5k – down 31k contracts since October 21st. This group of traders tend to follow the trend.

For now, gold (1,197.50) deserves the benefit of the doubt, until proven otherwise. In a worse-case scenario, there is always a possibility that it heads toward 1,000-1,050.