US home prices continue to rise. Consumer sentiment is more or less sideways at an elevated level. Supply of homes is limited. The cycle marches on.

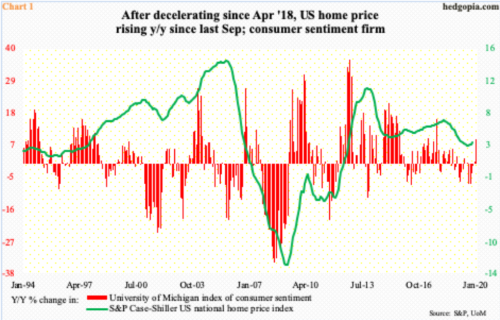

Nationally, using the S&P Case-Shiller national home price index, US home prices appreciated 3.5 percent year-over-year in November. Since last August when the rate of increase bottomed at 3.1 percent, prices have slightly trended higher (Chart 1).

The y/y change has remained in the positive territory since June 2012. As recently as March 2018, prices were rising at a 6.5 percent clip. This cannot be hurting consumer sentiment.

In January, the University of Michigan’s consumer sentiment index fell two-tenths of a point month-over-month to 99.1, but rose 8.7 percent year-over-year. Except for last August’s 89.8, sentiment has remained north of 90 since November 2016, four of which were 100 or higher.

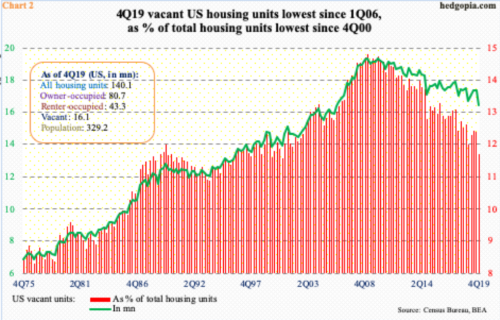

One of the reasons home prices have sustained at a higher plateau is the lack of supply. As of 4Q19, there were 16.1 million vacant units. This is out of the total housing units of 140.1 million. In other words, 11.5 percent were lying vacant – a 19-year low (Chart 2).

In a normal environment, when inventory is this tight, this should continue to put upward pressure on price. This, in turn, is a recipe for sentiment tailwind.

Thanks for reading!