Since the euro peaked in March last year, it has consistently been a loser’s game to try to pick a bottom.

For the umpteenth of time, the currency — and FXE, the euro ETF — has looked like it was stabilizing, only to come under renewed selling pressure.

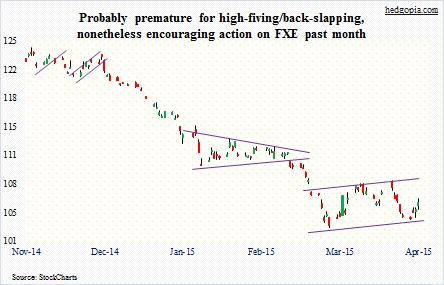

Once again, the ETF (105.89) is showing some encouraging action.

Since it made an intra-day low of 102.92 on March 13th, it has so far carved out higher lows.

It is possible short interest played a role in this. At the time of that low, short interest stood at 5.3 million, which by the 31st had dropped to 3.9 million. Between the periods, the ETF rose just under three percent. Short-covering probably helped.

So medium- to long-term it may be premature to get too excited by all this. The 50-day moving average continues to point lower. There is a long ways to go before the average stabilizes.

That, however, does not mean that the ETF cannot attract bids near-term.

If it rallies to the upper end of the range it has found itself in, there is potential to earn some premium in options — just to generate some income.

The assumption in this is that in the next couple of weeks, it does not bolt out of 110 (April 6th high of 108.51 and 50DMA at 108.05), nor does it take out the recent low.

If it stays within 109 and 104 by May 1st, an iron condor trade nets a credit of 31 cents.

Here is a hypothetical structure:

Long 110 call for $0.12

Short 109 call for $0.22

Short 104 put for $0.46

Long 103 put for $0.25

Mario Draghi, ECB president, on Wednesday pretty much said he was on course to completing the current bond-buying program. The currency digested that well. A potential headline risk can come out of the next Eurogroup meeting scheduled for the 24th (next week). Greek bonds were under pressure yesterday, with short- and medium-term yields soaring. If there is no progress in that meeting, Greece will not be receiving the last tranche of aid, which is needed to repay loans to the ECB and IMF.

In a worse-case scenario in which FXE breaks 103 (or 110, for that matter), risk (69 cents) will be limited.