The Friday before January 25th Greek elections, the euro closed at $1.123. Yesterday, one euro bought $1.133.

Since anti-austerity Syriza party swept to victory late January in Greece, the euro – by default FXE, the Currency Shares Euro Trust ETF – came under pressure for a while but then it quickly stabilized.

The ETF rallied 9.5 percent between the mid-March low of 102.92 and the mid-May high of 112.68. Since that high, it dropped to 106.38 in the next several sessions before rallying back near those highs. In the process, it hammered out a ‘higher lows, higher highs’ pattern (Chart 1).

The bottom line: For over three months now, FXE has never acted like Greece is headed for a crisis.

Shorts are either giving up or getting squeezed. When FXE made that mid-March low, short interest on the ETF stood at 5.3 million. By end-May, this had decreased to 3.3 million. (Mid-June numbers will be published tomorrow.)

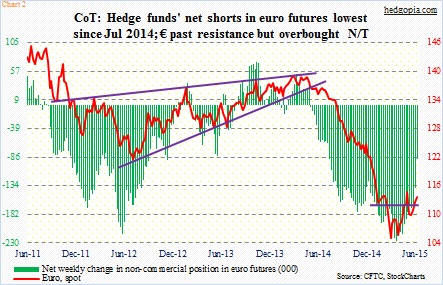

Also in the futures market, non-commercials are cutting back on their bearish stance on the euro. Last week, they reduced net shorts in euro futures by 35 percent week-over-week, to 89,400 contracts – the lowest since July 2014. From the end-March high of 226,560 contracts, they have reduced net shorts by 61 percent (Chart 2). A couple of weeks before that, the euro bottomed.

Amidst all this, we still do not know if Greece is headed for a default or the two sides will agree to an amicable solution.

If there is no agreement, it is a no-brainer. The hard deadline for Greece is June 30, when its bailout agreement ends and payment is due to the IMF. In this scenario, the ETF will take a pounding – especially considering that on a daily basis technical conditions are overbought.

If there is an agreement, this should not come as a big surprise. The currency has been anticipating one anyway – reason why it has held its ground at least the past three months. Initial euphoria liked gets sold.

In recent months, Greece probably was a major variable in deciding which way the euro went, but it was not the sole arbiter.

Recent eurozone economic data have not been as bad as in past quarters. On the other hand, U.S. data – particularly in the first quarter – was soft. The second quarter is looking better, although 2015 expectations are getting lowered versus just a few months ago. Last week, the FOMC cut its real GDP growth forecast from previous 2.3 to 2.7 percent to a new range of 1.8 percent to two percent. For all intents and purposes, the recent strength in the euro probably reflects this.

As most U.S. data softened in the first quarter, the U.S. dollar, whose explosive rally since the middle of 2014 was built on the premise that the Fed was ready to hike sooner than later, began to come under pressure. The US Dollar Index peaked on March 16, three days after the euro bottomed. The latter makes up 57.6 percent of the dollar index. The downward push on the dollar was a tailwind for the euro.

Of late, U.S. data seems to be shaking off 1Q weakness. The Atlanta Fed’s GDPNow model currently forecasts 1.9-percent real GDP growth. In the first quarter, real GDP shrank 0.7 percent. Importantly on a daily basis, the same way the euro is grossly overbought technically, the dollar index is oversold.

Mix it all up, and a case can be made that the euro likely comes under downward pressure – at least near-term. On FXE (111.31), resistance at 112-plus goes back five months. If it gets taken out, it is possible it quickly adds a point or two. That is the upside risk. But it is probable that, for reasons cited above, the rally gets sold. This, assuming the ETF manages to push through 112-plus.

Weekly June 26th FXE 112 calls fetch $0.38. Hypothetically, a naked call, if called away, ensures a short position at 112.38 – near the aforementioned resistance. Else, the premium is kept.

Thanks for reading!