Chinese stocks have been on fire! From an intra-day low of 36.62 on June 24, FXI (iShares Trust FTSE-Xinhua China 25 Index Fund) shot up nearly 13 percent to 41.30 in a little over a month (by July 29, to be precise); along the way there were several gap-ups. This is quite an about-face for an ETF that was down 3.5 percent in 1H14. In contrast, EEM (iShares MSCI Emerging Markets) was up 3.4 percent in the first six months, and the S&P 500 Index up six percent.

What changed? Have worries about what some have described as “epic” property bubble in China subsided? Is the excessive amount of debt accumulated over the years at the local government level no longer on investor radar screen? Are Xi Jinping and his team succeeding in transitioning the Chinese economy from excessive reliance on investment into consumption – in a so-called rebalancing? No, none of the above. These issues continue to remain on investor psyche.

Clearly, as far as the powers-that-be are concerned, the choice is between growth and reform – former to juice up numbers now and the latter with an eye toward building a foundation for tomorrow. As 2014 was rung in, Chinese leaders seemed to be favoring the latter. Then, we saw 1Q14 real GDP moderating to 7.4 percent year-over-year. The housing market was correcting as well. Investors were beginning to worry that the official 7.5-percent GDP growth target for 2014 may not be achieved. The government responded – with more stimulus. Incidentally, this is exactly how things unfolded in 2012 and 2013 as well. Growth decelerated in 1Q, followed by introduction of government stimulus. This time around, the State Council asked the People’s Bank of China and various ministries to take supportive measures. They complied.

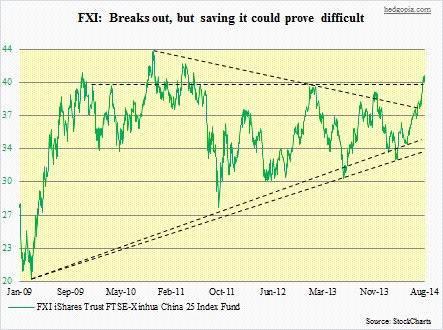

Housing also came under pressure in 2008 and 2012. That merely proved to be a cyclical correction. But in the process, excesses got bigger. Reason why the Chinese authorities tightened monetary conditions in 2H13, which probably was the primary reason behind the latest downturn in housing. Bubbles have lives, and they can always get bigger. There is a steady increase in the urban population in China. Incomes are rising as well. For the time being, the authorities will do their best not to let the air come out of it all at once. Investor expectations thus are that Beijing will continue to be accommodative at least for the rest of the year. Plus, China plans to allow cross-border stock investment between Shanghai and Hong Kong – a step towards opening China’s capital account and letting Chinese investors buy foreign equities. All these factors have helped solidify investor perception that good times are here to stay. And they have voted with money. The FXI advanced nearly six percent in two weeks (currently $40.47). As the chart shows, the frenzy began when the ETF broke out of a late-2010 trendline around $38.50. That breakout also took out a five-year, straight-line resistance around $40. So technically nothing could be going better. The problem is, as soon as that breakout occurred, the very next week the ETF flashed a distribution signal. The question is, do China bulls have enough wherewithal left to defend that $40 level? Not likely. Technicals are now way overbought. When that $40 support gives in, the next one to watch is $34-$35. Fundamentally, if the Chinese economy is merely responding to these short-term stimulus measures, the effect has to be transient. After all, leverage has only gone up, and the more one uses it, the less its efficacy. The government is between a rock and a hard place.

Housing also came under pressure in 2008 and 2012. That merely proved to be a cyclical correction. But in the process, excesses got bigger. Reason why the Chinese authorities tightened monetary conditions in 2H13, which probably was the primary reason behind the latest downturn in housing. Bubbles have lives, and they can always get bigger. There is a steady increase in the urban population in China. Incomes are rising as well. For the time being, the authorities will do their best not to let the air come out of it all at once. Investor expectations thus are that Beijing will continue to be accommodative at least for the rest of the year. Plus, China plans to allow cross-border stock investment between Shanghai and Hong Kong – a step towards opening China’s capital account and letting Chinese investors buy foreign equities. All these factors have helped solidify investor perception that good times are here to stay. And they have voted with money. The FXI advanced nearly six percent in two weeks (currently $40.47). As the chart shows, the frenzy began when the ETF broke out of a late-2010 trendline around $38.50. That breakout also took out a five-year, straight-line resistance around $40. So technically nothing could be going better. The problem is, as soon as that breakout occurred, the very next week the ETF flashed a distribution signal. The question is, do China bulls have enough wherewithal left to defend that $40 level? Not likely. Technicals are now way overbought. When that $40 support gives in, the next one to watch is $34-$35. Fundamentally, if the Chinese economy is merely responding to these short-term stimulus measures, the effect has to be transient. After all, leverage has only gone up, and the more one uses it, the less its efficacy. The government is between a rock and a hard place.

Considering all this, odds are very high that the $41.30 high does not get taken out anytime soon. A risk reversal strategy seems apt – by selling Sep14 40 calls for $1.37 each and using that money to purchase Oct14 40 puts for $1.25 each.