After sharp rallies off of February 11th lows, major U.S. indices have hit the wall, with some technical damage to boot.

Between February 11th and April 20th, the S&P 500 large cap index rose 16.6 percent. Between February 8th and April 19th, the Nasdaq 100 rallied 17.6 percent. And between February 11th and April 27th, the Russell 2000 small cap index jumped 22.6 percent.

Off the recent highs through the intra-day low last Friday, they respectively dropped 3.4 percent, 6.4 percent, and 4.7 percent.

They all began to retreat from crucial levels.

The S&P 500 large cap index peaked last May at 2134.72. That high was unsuccessfully tested in July. The index then progressively made lower highs. A slightly declining trend line drawn from that May 2015 peak was repeatedly tested in the middle of April – unsuccessfully, of course (Chart 1).

The Nasdaq 100 is the weakest of the three. Apple (AAPL), which makes up nearly 12 percent of QQQ, the PowerShares Nasdaq 100 ETF, is teetering on the brink of a make-or-break level. Support at 92 – going back to June 2014, or even September 2012 – is a must-hold, and thus far, it has held. Through May 2nd, it lost nearly 18 percent in less than three weeks.

The Nasdaq 100 peaked earlier than the other two indices above, and is down the most, in the process losing crucial support at 4350, although barely. Where exactly did the sell-off begin? At a declining December 2015 trend line (Chart 2).

Similarly, the Russell 2000 small cap index, during the January collapse in U.S. stocks, fell out of a rising trend line drawn from March 2009. After a February hammer reversal, March and April were positive, with the April high kissing the underside of that trend line but getting rejected.

Last week, the Russell 2000 lost dual support at 1120-ish – horizontal line going back to September 2013 as well as two-month rising channel. Late April, it was rejected at the top end of the channel (Chart 3).

On Friday, both the S&P 500 and the Russell 2000 found support at their respective 50-day moving average. The Nasdaq 100 lost support at 4350, but held 4290; the latter goes back to November 2014.

In a rather twisted way, the Friday reversal was also helped by April’s rather poor non-farm-payroll numbers.

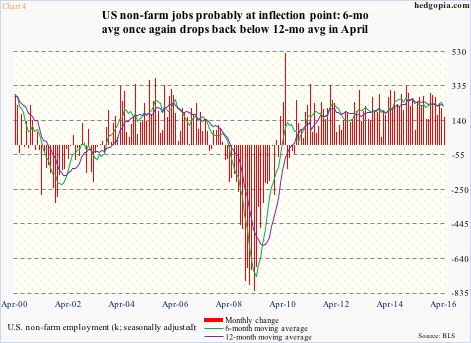

The U.S. economy added 160,000 non-farm jobs in April, with the year-to-date average of 192,000, which itself is smaller than the 2015 average of 229,000 and the 2014 average of 251,000. Momentum is in deceleration.

In Chart 4, monthly change in non-farm payroll is compared with its six- and 12-month moving averages. In April, the six-month once again dropped back below the 12-month. The crossover has occurred in 10 of the last 14 months. Notice the persistently shrinking red bars on the right side of the chart.

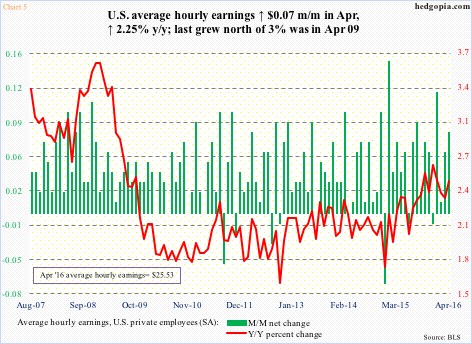

In the meantime, wages are still subdued. Average hourly earnings of U.S. private employees were $25.53 in April, up $0.08 month-over-month and up 2.5 percent year-over-year. The annual growth rate of 2.64 percent in December 2015 was the highest since 2.69 percent in July 2009. The last time earnings grew with a three handle was in April 2009 (Chart 5).

After April’s jobs report, June hike is probably off the table.

In December last year, the FOMC’s dot plot forecast four hikes this year – now cut to two. By the time the FOMC meets on June 14-15, they would also have seen May’s jobs numbers, with decelerating momentum.

Come Friday, stocks opened weak, but ended strong. Markets are betting that rate-hike odds have decreased significantly post-jobs report.

Of the three indices above, the S&P 500 is above both 50- and 200-day moving averages (Chart 1), the Russell 2000 is below 200-DMA but above 50-DMA (Chart 3), and the Nasdaq 100 below both 50- and 200-DMA (Chart 2). They can resist rally attempts. Besides, weekly indicators have rolled over.

In this context, the US dollar index can play an important role as to if stocks will continue to unwind weekly overbought conditions.

The US dollar index (93.88) has essentially been trapped in a rectangle since early last year, with the lower end at 92.50-93. The reason why loss of that support early last week was such an important development. But in the next four sessions, with a Tuesday hammer, it wrestled its way back above (Chart 6). Continuation of the rally will have negative implications for commodities, among others. Energy is 7.1 percent of SPY, the SPDR S&P 500 ETF.

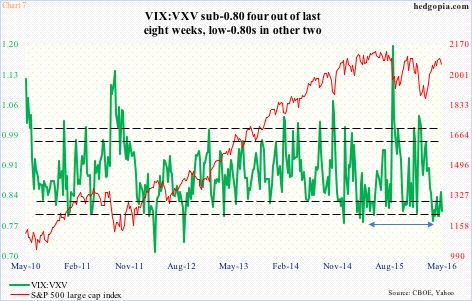

In this scenario – resistance on major indices holding and the dollar index rising – the VIX-to-VXV ratio has plenty of room to run. The ratio dropped to 0.782 on March 18th – a one-year low. Since then, there have been three other sub-0.80 readings, and two more in low-0.80s. All in all, there has been eight weeks of sideways move in oversold territory (Chart 7). A rise in the ratio means VIX rises more than VXV. More often than not, when demand for shorter-term volatility rises, stocks come under pressure.

Thanks for reading!