Apple, Inc.’s (AAPL) March quarter was a blowout – gross margin of 40.8 percent, along with 61.2 million iPhone units sold (135 million in six months), among others. It also increased buybacks to $200 billion from now through 2017.

The company estimates one-fifth of iPhone users have upgraded to iPhone 6 and 6+ (from a low-teens percentage in the December quarter). Which means the pool of potential upgraders remains large. The ASP was $658 in the quarter, up 11 percent year-over-year, suggesting the mix is shifting toward the 6+.

Nonetheless, the report was not without blemishes.

AAPL missed consensus iPad and Mac sales estimates; iPads are getting cannibalized by larger-screen iPhones. The increasing reliance on the iPhone is a concern. Apple Pay and Apple Watch are respectable initiatives, but it is too soon to declare them a success. A meaningful adoption of the iWatch in particular is a suspect. Management made it clear the iWatch will have lower gross margin than corporate average (iPhone’s is higher). There is momentum in greater China, which accounted for 30 percent of March-quarter sales – more than Europe – but ideally no company would want to depend too much on one geography or product.

The company also guided June-quarter gross margin to decline by 180 basis points at the midpoint sequentially.

Despite all this, the company remains a cash machine. Free cash flow was $16.7 billion in the March quarter. Net cash is $150 billion (versus a market cap of $760 billion).

What is not to like?

Well, plenty, it turns out. At least in the short term, stock prices can diverge from company fundamentals.

AAPL ($130.56) is one such instance.

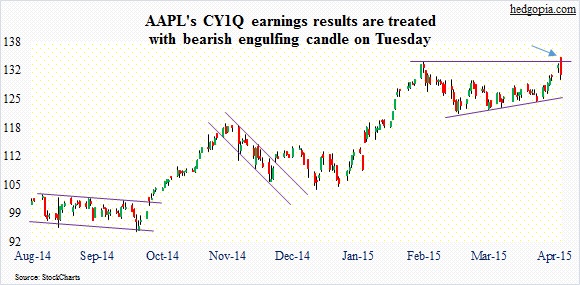

The stock rallied seven percent in six sessions into Monday’s post-close earnings announcement, but did not close out the session with a strong finish. The day produced a spinning top, followed by a large engulfing, high-volume candle (blue arrow in chart) on Tuesday.

After the reaction yesterday (Tuesday), it is hard to imagine buyers willing to put new capital to work right away – if at all. This probably creates an opportunity for those looking to generate income in options.

Here is a hypothetical bear call spread using May 8th weeklies:

Short 132 call for $1.49

Long 134 call for $0.88

This nets a credit of $0.61. The trade breaks even at $132.61; $1.39 is at risk, should the price push through $134.

Thanks for taking the time to read this post.

Please keep in mind that this article was originally published yesterday (April 29th) by See It Market, where I am a contributor.