No one seemed prepared for Brexit. Seriously. Polls were wrong. Bookmakers were wrong. Paddy Power, Ladbrokes, they all missed it.

Reaction in the various asset markets was equally treacherous.

Stocks dropped everywhere on Friday. The German Dax composite collapsed 6.8 percent, the French CAC 40 index eight percent, the FTSE 100 3.2 percent, with the latter down as much as 8.7 percent at session lows. The Nikkei 225 dropped 7.9 percent. Here at home, the S&P 500 lost 3.6 percent. Come Monday, these indices came in for more pounding.

In the currency land, the British pound dropped from $1.50 to $1.33 before closing Friday at $1.368. The euro lost 2.8 percent to $111.04. The Japanese yen jumped 4.5 percent to $97.85. And the US dollar index rose 2.2 percent to 95.57.

And bonds rallied. On Friday, German 10-year was yielding a record low minus 0.05 percent, Japanese 10-year minus 0.18 percent, and Switzerland 0.56 percent. U.S. 10-year Treasury was yielding 1.58 percent, even as Italy and Spain yielded less than the U.S.’s, while France’s was at 0.38 percent.

A market reaction of this sort only occurs when the unexpected happens… or, when they are pitched a curve ball.

Also not expecting the unexpected were equity shorts.

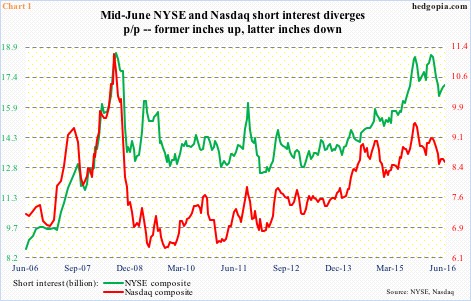

Ahead of the UK referendum on the 23rd, short interest in both the NYSE composite and Nasdaq composite remained pretty much nonchalant. In the latest period, it fell 0.7 percent period-over-period on the latter and rose 0.6 percent on the former (Chart 1).

To be fair, short interest on both indices remains elevated. On the NYSE in particular, the February 12th (2016) high of 18.5 billion was on par with the all-time high of 18.6 billion in July 2008.

Plus, the latest period is as of June 15th, so would-be shorts had six more sessions to position for Brexit/Bremain. Maybe they did. We will find out when June 30th holdings are reported on July 12th. That said, as of June 15th, that was definitely not happening.

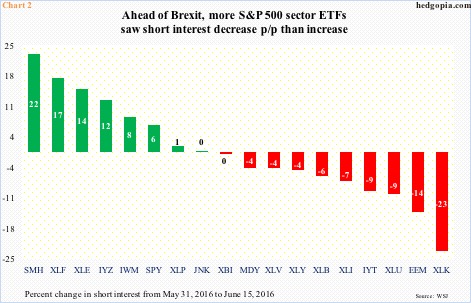

This is also evident among several sector/industry ETFs (Chart 2).

Of the 10 S&P 500 sectors – IYZ (telecom services), XLB (materials), XLE (energy), XLF (financial), XLI (industrials), XLK (technology), XLP (consumer staples), XLU (utilities), XLV (health care), and XLY (consumer discretionary) – short interest dropped p/p on most. Of the ones that witnessed an increase, XLE and XLF probably have sector-specific reasons.

Last week’s 2.6-percent drop in spot West Texas Intermediate crude was preceded by a genuine tug of war between bulls and bears – a gravestone doji followed by a dragonfly doji. Crude just about doubled in four months, and was giving out signs of fatigue. XLE was a way to play this.

XLF rallied as several FOMC members ratcheted up rate-hike talk. As that died down, the ETF came under pressure, and shorts got active.

SMH, the VanEck Vectors Semiconductor ETF, rallied nearly 30 percent off of the February 11th low, but that was not enough to push it past one-year resistance. Having failed to break out amid overbought conditions attracted shorts.

Of the ones that saw the most decrease in short interest, XLK dropped 1.7 percent during the May 31st-June 15th period, yet short interest dropped 22.6 percent to 19.2 million. The ETF was pounding at $44 resistance, and could pull off a breakout in the right circumstances. But little did these shorts know that Brexit was about to throw a curve ball.

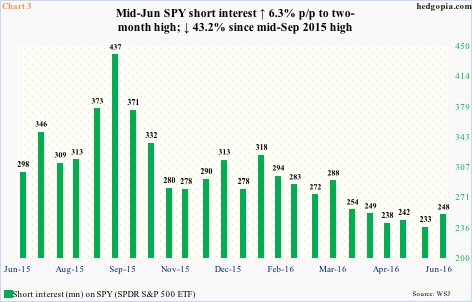

Ditto with shorts in SPY, the SPDR S&P 500 ETF. Mid-June short interest rose 6.3 percent p/p to 248 million, but from a depressed level. The May 31st reading was at a 14-month low. If these shorts expected a Brexit win, those green bars on the right side of Chart 3 would be a lot taller.

Thanks for reading!