Since last October’s bottom, tech has led. How it behaves in the weeks and months ahead will reverberate through the stock market. This week’s downward pressure is coming in the backdrop of exuberant sentiment.

After several weeks of giving out signs of fatigue, tech-heavy indices are taking a hit. With two sessions to go, the Nasdaq 100 is down 2.6 percent this week to 19799. This comes after a 0.3-percent slide last week. If this holds, this would be the first back-to-back decline in three months.

The tech-heavy index reached an all-time high of 20691 intraday on the 10th this month. Through that high, it was up 47.2 percent from the low of last October; the new record was set in a spinning top week. A weekly spinning top also appeared two weeks before that, which itself was preceded by a weekly gravestone doji.

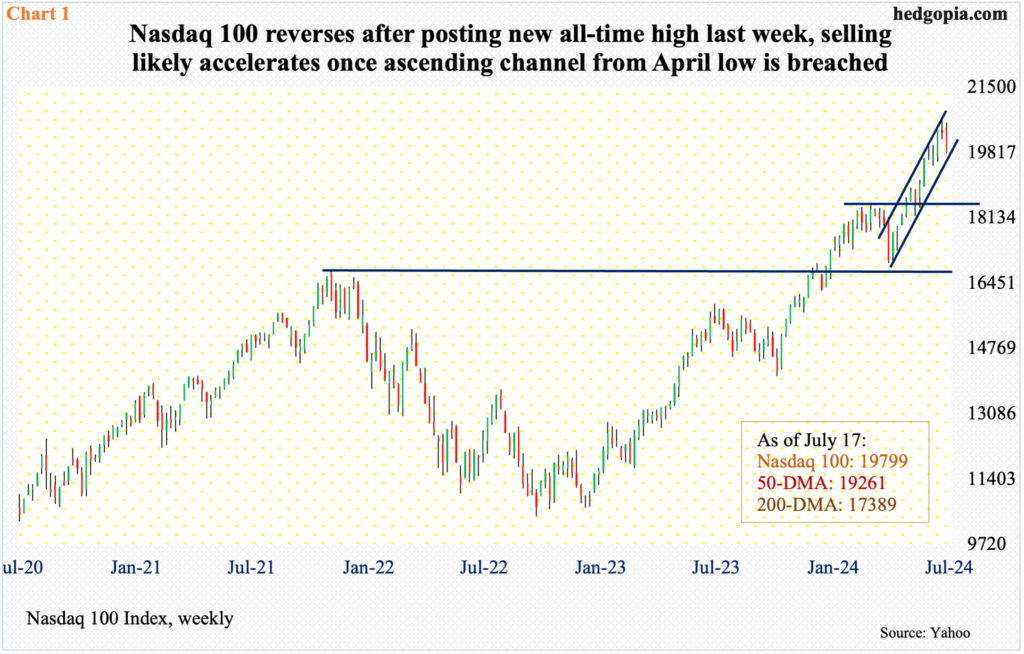

In other words, after the heady gains of the last nine months, signs of distribution are showing up. On Wednesday, the Nasdaq 100 finished at the lower end of a rising channel from the low of April (Chart 1). It is possible tech bulls will try to defend this support. But selling will accelerate once this gives way.

There is decent horizontal support at 18300s.

Sentiment is too bullish, and it will take a while before the froth is removed.

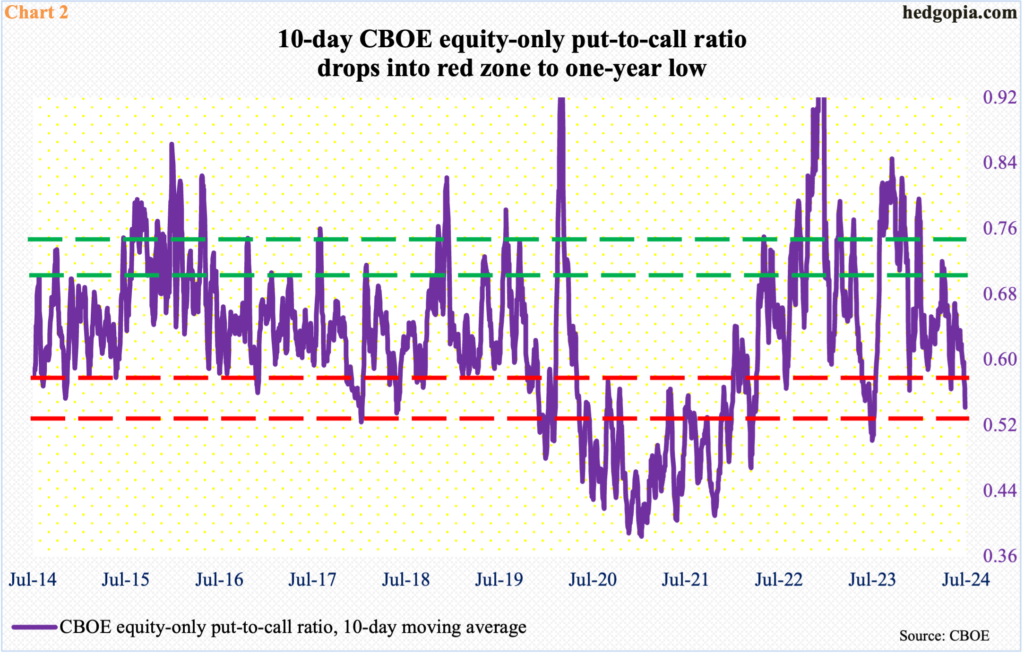

On Wednesday, the S&P 500 declined 1.4 percent and the Nasdaq 100 2.9 percent, yet the CBOE equity-only put-to-call ratio printed 0.53. A day before that, the ratio hit 0.49; this was the first sub-0.50 reading in four months. Back then – on March 18th, to be precise – these indices peaked shortly thereafter and dropped in mid- to high-single digits.

Wednesday’s 0.53-print represents nine of out of 10 0.50s reading – or lower – in a row. The 10-day moving average ended that session at 0.54 – a one-year low and well into the red zone (Chart 2).

Right now, no one wants to believe in the probability of a sustained move lower – reflected in Wednesday’s ratio. Once a sentiment reversal occurs, this will begin to get reflected in the violet line going the other way.

Sentiment surveys reflect similar exuberance. In the week to Tuesday, Investors Intelligence bullish percent increased nine-tenths of a percentage point week-over-week to 63.6 percent, while the bearish count dropped 1.2 percentage points to 16.7 percent. Bulls have not been this optimistic since April 2021, with this week’s reading the sixth week in a row of 60 percent or higher.

It is already rare for equity bulls to be in the 60s. It is much rarer to do so for six consecutive weeks. The last time this happened was in January 2021 (Chart 3).

The point in all this is that things are stretched, and, to be fair, they have been that way for a while now. Just because things are extended does not mean they have to reverse right away. But, if past is guide, the longer they defy gravity, the greater they drop.

Leading up to this week’s action, tech led and will most definitely lead on the way down. How the sector has acted in the last several sessions is worth paying attention to.

Thanks for reading!