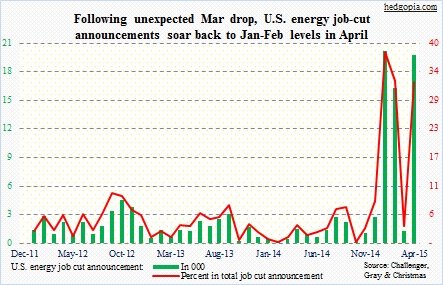

Turns out the March drop in energy job-cut announcements was not the beginning of a trend. After 20.2k and 16.3k cuts in January and February respectively, March dropped to a mere 1.3k, raising hopes that the worst was over.

Job cuts shot back up in April, to 19.7k (courtesy of Challenger, Gray & Christmas). As a percent of nationwide job-cut announcements, energy made up 32.1 percent in the month. Year-to-date, job cuts in the sector now total 57.6k, making up 28.5 percent of the total. For comparison purposes, there were 2.4k cuts in the first four months last year. No surprise there.

Statewide, TX tops with 69.8k cuts year-to-date; in April, there were 22.8k in the state.

Interestingly, the April jump in job cuts came even though oil had stabilized and was already moving up. Spot West Texas Intermediate crude rose 26 percent in the month.

Too soon to say if this is oil companies’ way of saying the worst is not over yet.

Bloomberg Intelligence tells us that there are north of 4,700 drilled but uncompleted wells out there. If the rally in the WTI holds, and maybe even manages to nudge higher from here, these companies will be incentivized to complete them quickly. Shale producers can respond to price movements very quickly. EOG, for instance, in February said it plans to close out 2015 with 285 uncompleted wells, up from 200 at end-2014. The company also told us recently that it plans to return to double-digit production growth should WTI reach $65 or higher. An automatic price cap!

Thanks for taking the time to read this post!