There is a lot of chatter these days around imminent asset purchases by the ECB. Speaking to the press post-Governing Council meeting yesterday, ECB President Mario Draghi hinted as much, saying policy makers are unanimous in their willingness to use unconventional measures if deemed necessary and that the central bank had “intensified” preparation for an asset-purchase program; he said they were willing to launch one if the inflation picture changed. Data already seems to be calling for action. Euro-zone inflation came in at just 0.4 percent in July, down from 0.5 percent in June, and versus the ECB’s mandate of near but just below two percent. Other economic data point to stagnation. Italy has plunged back into recession. Even Germany’s numbers of late are coming in weaker than expected. So if not now, when then? Market participants are betting that something is in the works. Since early May until the low yesterday, the euro has shed 4.7 percent. In the currency world, this is a big move in three months. The problem is, in the short-term, euro shorts are not likely to get much help on the news front. Two factors need consideration in this respect.

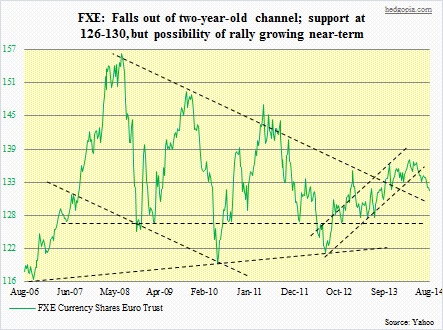

First, Draghi probably does not feel the need to act because the markets are doing it for him. Both the currency and bond yields (sovereign) have been declining. Euro zone economies including Italy and France have long complained that a strong euro is making them less competitive. Second, in its June meeting, the ECB adopted measures such as a cut to its key refinancing rate (to 0.15 percent), a cut to the deposit rate (to negative territory, at -0.1 percent), and targeted long-term refinancing operations (TLTROs). Draghi expects a “sizable” take-up of the TLTROs, of between €450bn and €850bn; these are due to take effect in September. The ECB in all probability would like to hold off from further policy action at least until then. In this scenario, a news vacuum results – not exactly what euro shorts are hoping things would turn out. Near- and medium-term technicals are now in oversold territory. Long-term indicators are in the process of unwinding overbought conditions. On a monthly chart, MACD is about to flash a sell signal. In the latter scenario, as can be seen in the adjacent chart, the FXE could very well be headed toward 126. But it is a bit premature to be planning for that scenario. Immediately ahead, odds are growing that the ETF stabilizes here. There are some early signs of that happening, but not concrete just yet. Since the May 8th piece, this is the first time I am looking for an opportunity to go long FXE. Wait-and-see for now.

First, Draghi probably does not feel the need to act because the markets are doing it for him. Both the currency and bond yields (sovereign) have been declining. Euro zone economies including Italy and France have long complained that a strong euro is making them less competitive. Second, in its June meeting, the ECB adopted measures such as a cut to its key refinancing rate (to 0.15 percent), a cut to the deposit rate (to negative territory, at -0.1 percent), and targeted long-term refinancing operations (TLTROs). Draghi expects a “sizable” take-up of the TLTROs, of between €450bn and €850bn; these are due to take effect in September. The ECB in all probability would like to hold off from further policy action at least until then. In this scenario, a news vacuum results – not exactly what euro shorts are hoping things would turn out. Near- and medium-term technicals are now in oversold territory. Long-term indicators are in the process of unwinding overbought conditions. On a monthly chart, MACD is about to flash a sell signal. In the latter scenario, as can be seen in the adjacent chart, the FXE could very well be headed toward 126. But it is a bit premature to be planning for that scenario. Immediately ahead, odds are growing that the ETF stabilizes here. There are some early signs of that happening, but not concrete just yet. Since the May 8th piece, this is the first time I am looking for an opportunity to go long FXE. Wait-and-see for now.