The sell-side is beginning to revise earnings estimates lower. But looking at the disruptions caused by the coronavirus, more downward revisions probably lie ahead. Company boards will be looking to conserve cash, with dividends and buybacks likely targets – the latter in particular.

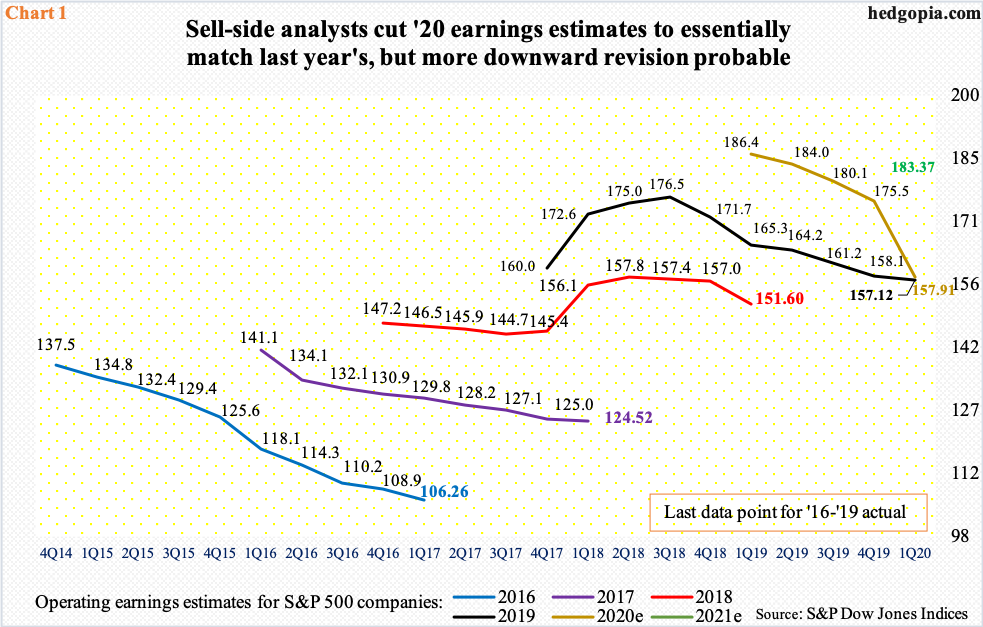

The knives are out. The sell-side reduced this year’s operating earnings estimates for S&P 500 companies to essentially match last year’s, but this in all probability is not going to be enough.

Last year, these companies earned $157.12, although estimates in August 2018 were as elevated as $177.13. In a similar fashion, this year’s estimates in March last year were $186.36. Now, the sell-side expects $157.91 this year (Chart 1), down $15.13 in March alone. These analysts obviously are trying to model in coronavirus-spurred disruptions to the bottom line. They are probably not done lowering their numbers.

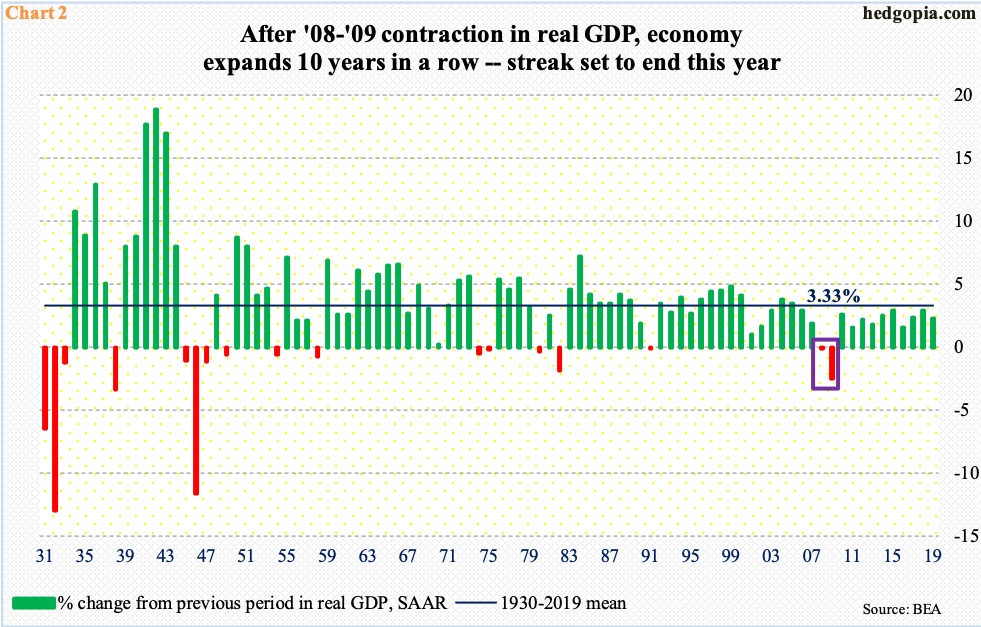

Last year, real GDP grew 2.3 percent in the U.S. It is futile to guess what the next three quarters will bring and what trajectory the virus will take. GDP forecasts run the gamut. It is safe to assume it is going to be a down year. If so, this would have been the first down year in 11 years. In 2009, the economy contracted 2.5%, following a 0.1-percent drop in the year before (box in Chart 2).

In 2007, S&P 500 operating earnings were $82.54, which tumbled to $49.51 in 2008, before rebounding to $56.86 in 2009. The revision path going forward may not have to – and likely will not – follow the same trajectory, but this does offer a glimpse into where earnings might be headed this year and next.

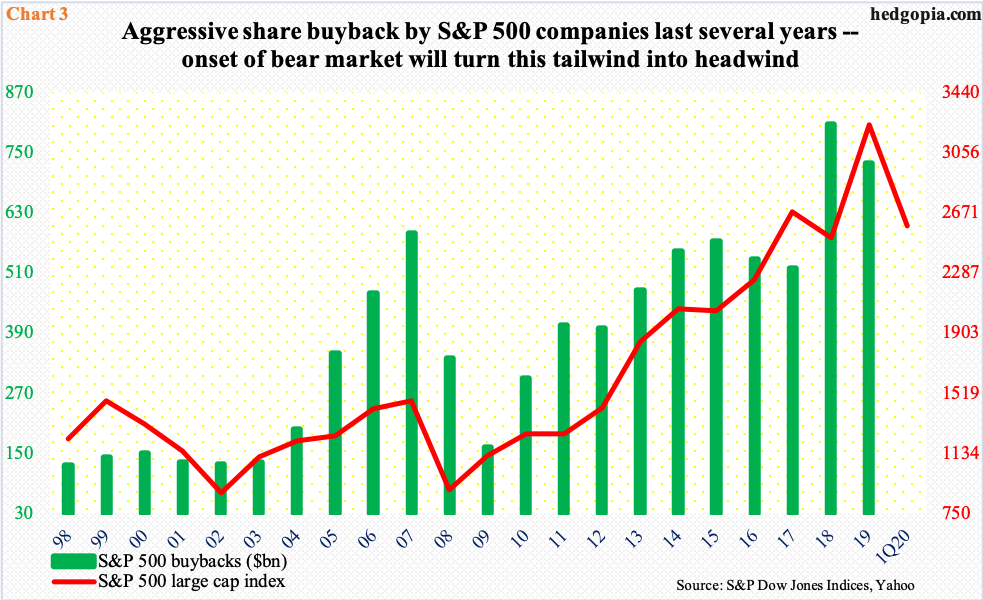

A contraction in earnings is bound to reverberate through both dividend distribution and buybacks. Corporate boards try not to touch dividends unless they are forced to. This year, they have no option, as they try to raise cash.

Already, companies ranging from Boeing (BA) and Ford (F) to Marriott (MAR) and Delta (DEL) have announced dividend suspension.

Over the last several years, S&P 500 companies have been very generous with dividends. In 1Q20, dividends per share were $15.32 – a record. Last year, these companies doled out $485.5 billion in dividends – also a record. Once again, it is anyone’s guess as to what kind of a haircut dividends will face this year. Boards first will go after buybacks.

In 2019, S&P 500 companies bought back $728.7 billion in their own shares. This followed record $806.4 billion worth in 2018 (Chart 3). In the last cycle, after peaking in 2007 at $589.1 billion, buybacks tumbled 42 percent in 2008 and then another 52 percent in 2009. This time around, duration and magnitude of the imminent drop notwithstanding, buybacks will be falling from a much higher spot. They have been a big tailwind for stocks. This is now developing into a headwind.

Thanks for reading!