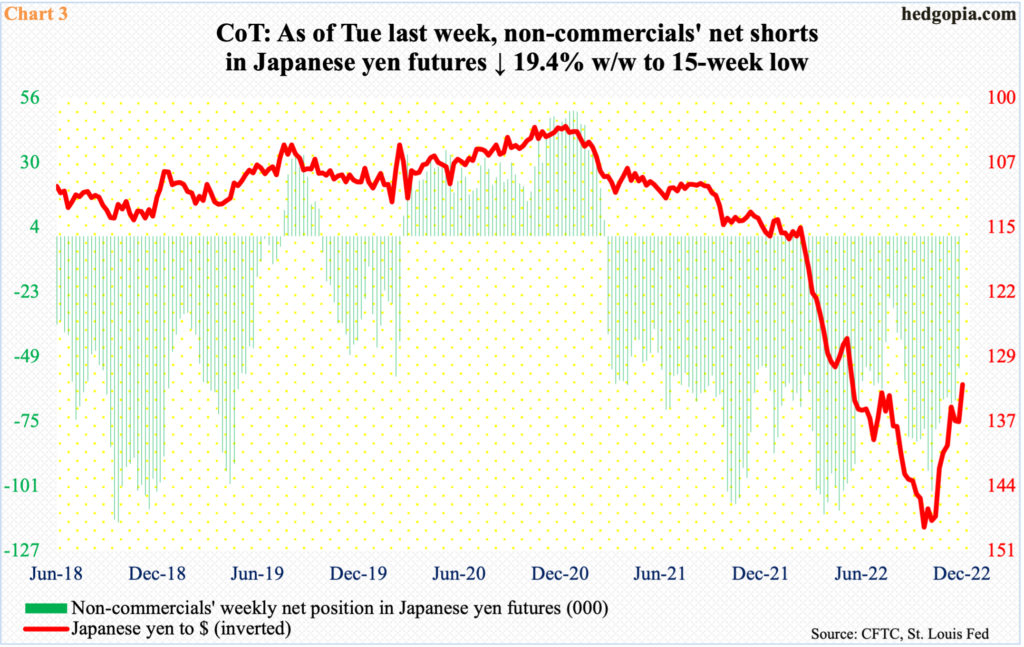

The BoJ took everyone by surprise this week. Shocked markets have concluded that the central bank, which lagged its global peers in rate tightening, has no other alternative than to join them. In the futures market, non-commercials’ net shorts in Japanese yen futures were at a 15-week low as of Tuesday last week.

On Tuesday, the Bank of Japan caught literally everyone off guard by allowing the 10-year Japanese bond to move 50 basis points either side of its zero percent target. Previously, the band was 25 basis points.

Markets were not ready for this. Governor Haruhiko Kuroda is due to leave next April, and everyone assumed the status quo will be maintained until at least he left. At a news conference, Kuroda said this was not meant to be an interest rate hike and that the tweak was not a prelude to a bigger change to its yield-curve-control policy, but markets were not convinced.

The Nikkei tumbled 2.5 percent and the 10-year yield rose as high as 0.46 percent. Repercussions were felt across currencies, with the US dollar coming under decent pressure.

It increasingly feels like Japan is getting ready to gradually wind down what has been a massive experiment in loose monetary policy lasting years.

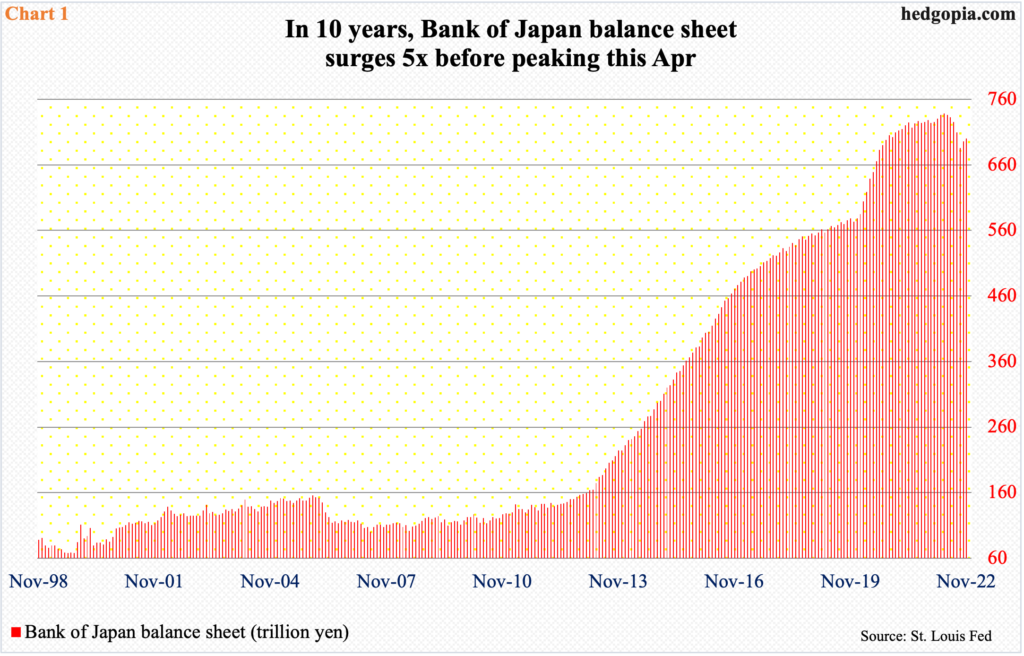

In April 2012, the Bank of Japan held 141 trillion yen in assets. Ten years later – that is April this year – this had ballooned to 739 trillion yen. Since that peak, it has come under slight pressure, with November at 700 trillion yen (Chart 1).

The BoJ’s easy monetary policy led Japanese assets to rush abroad for higher returns. If and when these managers decide to repatriate the money home, repercussions will be felt across assets and globally.

On Tuesday, the Japanese yen rallied four percent against the US dollar. In the currency world, this kind of a daily move is almost unheard of. That says a lot about how the markets are viewing the BoJ action and are trying to pre-empt further tightening ahead, which now looks imminent.

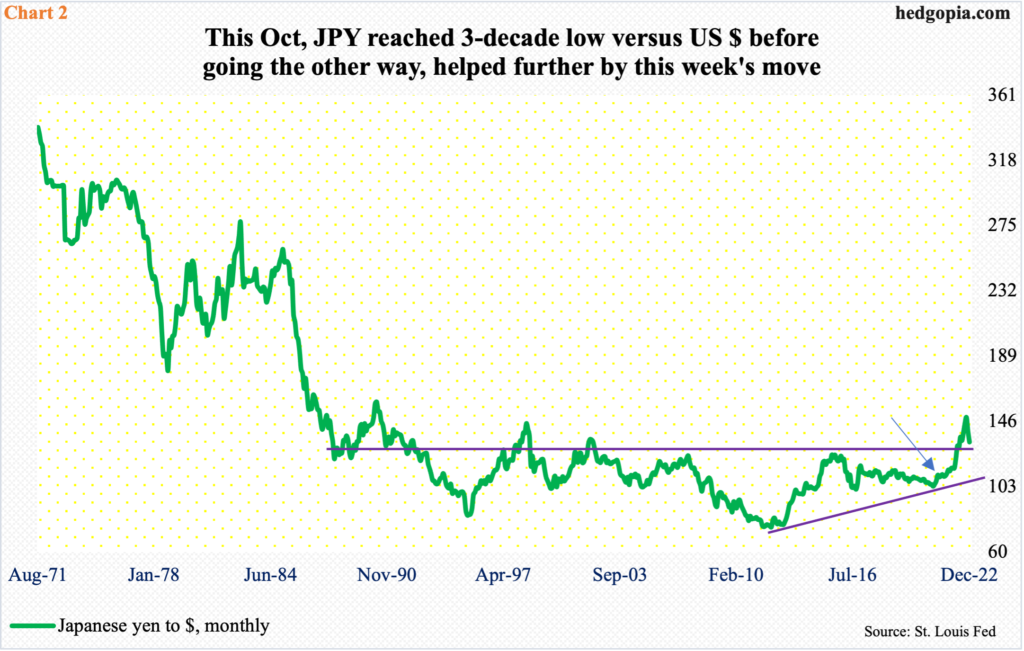

Interest rates are rising globally. The BoJ has not reciprocated. The difference between rates in Japan and other countries is widening. This leaves the yen vulnerable. On September 22 (this year), for the first time since 1998 (during the Asian financial crisis), Japan intervened in the foreign exchange market buying the yen. This was followed by another intervention on October 21; the yen ticked 151.95 – a three-decade low – against the dollar in that session before reversing.

This Monday, the JPY closed at 136.95. Then came the BoJ surprise. On Tuesday, the currency sliced through the 200-day moving average to tag 130.60 intraday and close at 131.74, followed by a slight rise to close Wednesday at 132.35.

Regardless where it goes near term, considering the new dynamics, the yen’s path of least resistance is up. In this regard, there is multi-year resistance at 124-125. This level bears watching. For this to yield, the BoJ has to be tightening much more.

In the meantime, non-commercials have been reducing their net shorts in Japanese yen futures. As of Tuesday last week, they held 53,188 contracts – a 15-week low. (This week’s will be out tomorrow.) At the same time, they have been actively cutting back.

In the week to October 25, which was the week the yen bottomed, they were net short 102,618 contracts (Chart 3).

The last time these traders were net long was March last year. That was about when the yen was beginning to break down (arrow in Chart 2), and these traders rode it well. Now, they seem to be getting ready to go the other way.

Thanks for reading!