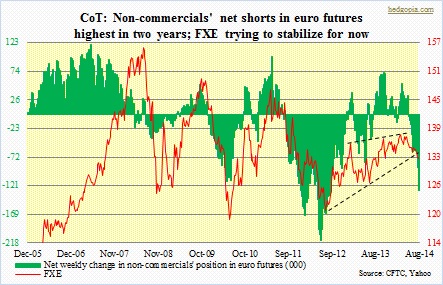

Non-commercials further added to net shorts in euro futures. They are now net short 129k contracts – a two-year high. In recent weeks these large speculators have been adding more shorts than cutting longs. Since early June, they cut longs by less than 2k contracts, even as shorts have gone up by 94k. During the period, the euro was down 1.8 percent (FXE, 132.27 as of August 8th). This has emboldened the shorts. And why not? They have so far been on the right side of this trade. Nevertheless, longs have been steadfast in their conviction, as they are yet to drastically cut back. This probably suggests two things. One, longs are yet to give up, which, if it materializes, has the potential to push the currency even lower. Two, shorts are overly zealous, and that they will be forced to cover, which could put upward pressure on the price. The CFTC report is published each Friday reflecting trades as of the prior Tuesday. So as far as futures are concerned, we do not know what transpired on Wednesday, Thursday and Friday. But we do know this. The price action in the euro is trying to say something. For the last several sessions, bulls and bears have been locked into a real duel. The former is gradually stepping up to the plate. So the net-shorts number could look entirely different when the next report is published. Now it is a different discussion altogether as to if the expected rally/bounce is short-, mid- or long-term in nature. Long-term, technically the euro has room to go lower. Mid- and short-term, technicals are now oversold.

Non-commercials further added to net shorts in euro futures. They are now net short 129k contracts – a two-year high. In recent weeks these large speculators have been adding more shorts than cutting longs. Since early June, they cut longs by less than 2k contracts, even as shorts have gone up by 94k. During the period, the euro was down 1.8 percent (FXE, 132.27 as of August 8th). This has emboldened the shorts. And why not? They have so far been on the right side of this trade. Nevertheless, longs have been steadfast in their conviction, as they are yet to drastically cut back. This probably suggests two things. One, longs are yet to give up, which, if it materializes, has the potential to push the currency even lower. Two, shorts are overly zealous, and that they will be forced to cover, which could put upward pressure on the price. The CFTC report is published each Friday reflecting trades as of the prior Tuesday. So as far as futures are concerned, we do not know what transpired on Wednesday, Thursday and Friday. But we do know this. The price action in the euro is trying to say something. For the last several sessions, bulls and bears have been locked into a real duel. The former is gradually stepping up to the plate. So the net-shorts number could look entirely different when the next report is published. Now it is a different discussion altogether as to if the expected rally/bounce is short-, mid- or long-term in nature. Long-term, technically the euro has room to go lower. Mid- and short-term, technicals are now oversold.

There are umpteenth reasons to be negative on the euro. In fact, it just broke down falling out of a two-year-old channel. Add to that the fact that European Central Bank President Mario Draghi is increasingly sounding dovish, talking about potential asset purchases. Plus, the euro-zone economy is weaker than expected. Even Germany is not immune from this. German exports bounced back in June, but other data including industrial production have been disappointing. Last but not the least, capital has been flowing into euro-zone stocks and bonds. Yield on the German bund was recently at an all-time low. These are well-known issues, and in all likelihood in the price. Of them all, if money starts to leave euro-zone assets in earnest, then that could put a damper on rally hopes. Nevertheless, this likely is a long-term issue. In the very near-term, though, the FXE has room for a bounce/rally, to 133.50 and in the right circumstance even 135.