Not much has changed fundamentally since Twitter (TWTR) was last discussed. That was Monday last week (prior lengthy discussion here). Except President Obama has his own Twitter account now.

In the past week, earnings estimates for the second and third quarters have remained unchanged at five and six cents respectively, as have for 2015 and 2016, at $0.34 and $0.67, in that order.

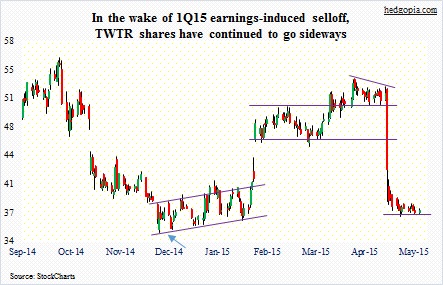

The stock is still trying to digest the earnings-induced drop. For the past eight sessions, it has been bobbing up and down in less than a dollar range, around its 10-day moving average.

In normal circumstances, it takes time for stocks to stabilize after taking a shellacking the kind of which TWTR took post-1Q earnings three weeks ago. It is a process, and it takes time.

Short-term is another matter.

The stock is grossly oversold on a daily chart, and is wound up tight. Bollinger bands are still very wide, but some others such as the MACD could be on the verge of a crossover.

This is perhaps setting up as yet another opportunity to write weekly out-of-the-money puts – a cash-secured put, just in case. May 22nd 37 puts are selling for $0.39. So if put, it is an effective long at $36.61, which is pretty close to the May 6th low of $36.52.

The risk is this. If TWTR breaks the $36.50-$37 support, shares could quickly head toward $35, toward December lows (blue arrow in chart above). Under this scenario, by then daily conditions would be even more oversold, raising the odds of a bounce.