Based on the first five months, US corporate bond issuance is on course for another down year. Particularly noteworthy is the collapse in issuance of junk bonds. Investors have switched to risk-off.

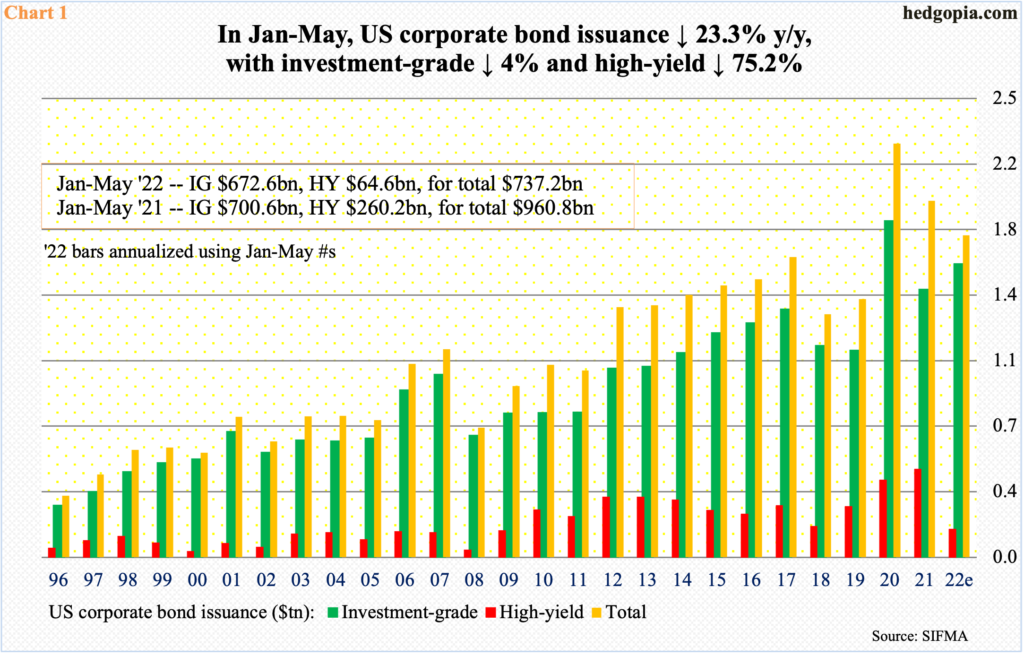

The pace of US corporate bond issuance has cooled down. In the first five months this year, issuance has totaled $737.2 billion, made up of $672.6 billion in investment-grade and $64.6 billion in high-yield. This compares with $700.6 billion in investment-grade and $260.2 billion in high-yield, for a total $960.8 billion, in the comparable period last year.

Annualizing the first five months, 2022 is on course for $1.77 trillion in issuance, which will be a second down year in a row (Chart 1). Issuance reached an all-time high of $2.27 trillion in 2020, followed by $1.96 trillion last year.

Breaking down total issuance, if the trend seen in the first five months holds up, $1.61 trillion will have been issued in investment-grade this year. In 2020, a record $1.85 trillion was issued.

High-yield, in the meantime, is on pace to collapse this year. At the current pace, corporations will have issued $155 billion this year, which pales in comparison to last year’s record $485 billion (Chart 1).

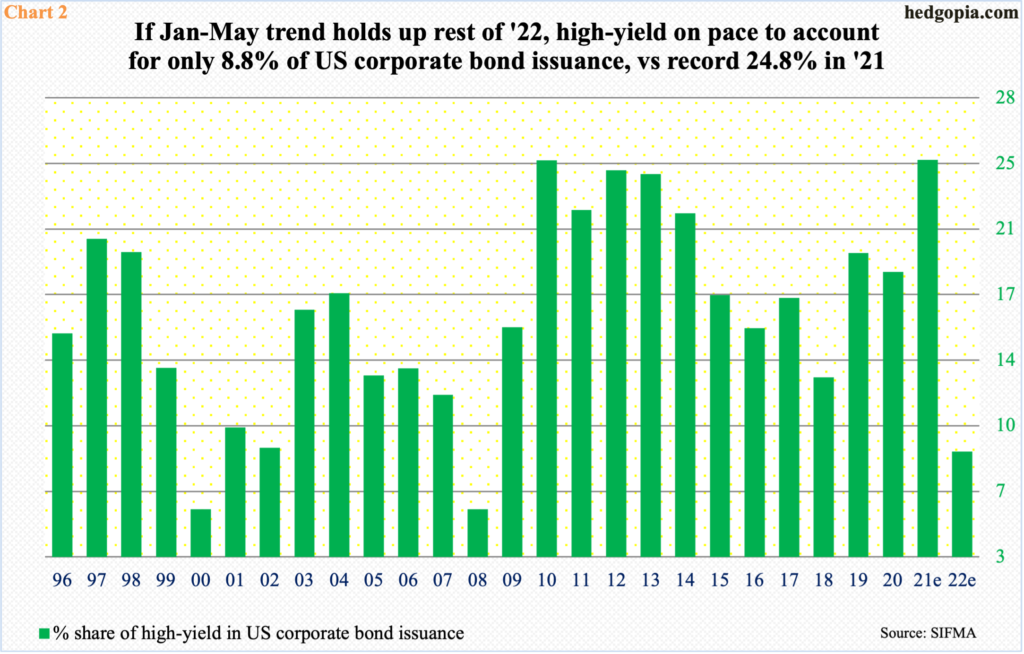

The tumble in high-yield issuance so far this year can also be seen through its percentage share in total issuance. On this basis, if the January-May pace holds up, high-yield’s share would equal 8.8 percent, versus last year’s record 24.8 percent. This will be the lowest share since cratering to 5.6 percent in 2008 (Chart 2).

High-yield pays higher interest rates – relatively, that is – and carry default risks in times of economic duress. They are called junk for a reason. In good times, demand remains high. The opposite is true when times are tough – or about to get tough. This in and of itself is an indication which way markets perceive the US economy is headed.

Thanks for reading!