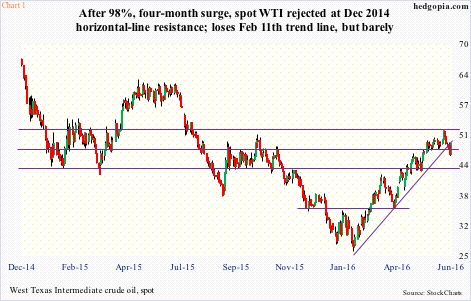

If the past couple of weeks were an indication, bulls and bears are locked in a vicious tug of war over the near- and medium-term direction of crude oil. From the February 11th low to the June 9th high, spot West Texas Intermediate crude ($48.86) surged 98 percent, before getting rejected at horizontal-line resistance from December 2014 (Chart 1). From that high through last Friday’s low, it quickly lost five points. This was a win for the bears, but the bulls were not going to succumb under pressure. The latter rather rolled up their sleeves.

From the February 11th low to the June 9th high, spot West Texas Intermediate crude ($48.86) surged 98 percent, before getting rejected at horizontal-line resistance from December 2014 (Chart 1). From that high through last Friday’s low, it quickly lost five points. This was a win for the bears, but the bulls were not going to succumb under pressure. The latter rather rolled up their sleeves.

Crude rallied five percent last Friday, with the session low tagging the 50-day moving average. Consequently, what at one point was down 5.1 percent, the week closed unchanged. Quite a comeback!

Technically, on spot WTI’s weekly chart, last week produced a dragonfly doji. This came on the heels of a gravestone doji in the prior week. That is why it gets interesting. Both sides are putting their foot down. How it shakes up in the days ahead is anyone’s guess.

Crude’s daily conditions are oversold. At the same time, it has lost the February 11th rising trend line, albeit ever so slightly (Chart 1). Given weekly overbought conditions, medium-term bias is still down, but the Friday reversal has given hope to the bulls – at least near-term. XLE, the SPDR energy ETF, is in the midst of similar dynamics. Last week, bulls refused to give up, preceded by bears’ attack near December 2007 resistance in the prior week (Chart 2). Last Thursday, it found support near the lower Bollinger Band, also retaking the 50-day moving average. As is the case with spot WTI, there is room to rally near-term, with tons of room to come under pressure medium-term.

XLE, the SPDR energy ETF, is in the midst of similar dynamics. Last week, bulls refused to give up, preceded by bears’ attack near December 2007 resistance in the prior week (Chart 2). Last Thursday, it found support near the lower Bollinger Band, also retaking the 50-day moving average. As is the case with spot WTI, there is room to rally near-term, with tons of room to come under pressure medium-term.

With the UK’s EU referendum this week, XLE ($66.89) could go either way near-term. Hypothetically on June 14th, it was shorted at $67.17. Since then, it did drop to $64.91 intra-day last Thursday, but the reversal was as quick. Prudent to stay out of the way for now.

Thanks for reading!