S&P 500 companies are doling out record dividends. Because the index has rallied massively, the dividend yield continues to linger around two percent. This is still better than what the long end of the sovereign bond market is yielding, helping stocks further.

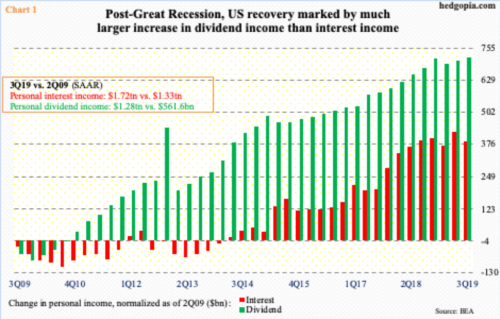

Post-Great Recession, the increase in US dividend income is far superseding that from interest. Income received from dividends went from a seasonally adjusted annual rate of $561.6 billion in 2Q09 to $1.28 trillion in 3Q19, while interest income over the same time period went from $1.33 trillion to $1.72 trillion (Chart 1). Between the periods, interest income rose 29.4 percent, even as dividend income jumped 128.1 percent.

Viewed another way, interest income made up 9.2 percent of total personal income in 3Q19, down from 11 percent in 2Q09. In contrast, dividends’ share in total personal income rose from 4.6 percent to 6.8 percent.

In the wake of the financial crisis of more than a decade ago, interest rates continue to languish at multi-decade lows, while corporations have been generously doling out dividends.

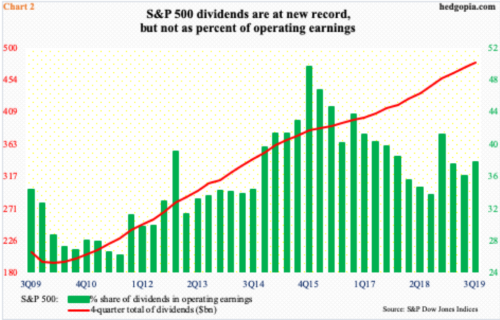

S&P 500 companies are paying out record dividends. On the 17th this month, the S&P 500 indicated that the dividend rate reached $500 billion – a record and a first.

Chart 3 uses numbers up to 3Q, with the four-quarter rolling total already at $478.9 billion. In 2Q09, this stood at $223 billion. On an absolute basis, dividends have witnessed massive growth.

As a percent of operating earnings, however, growth is subdued. On this basis, S&P 500 companies paid out 37.3 percent of operating earnings in dividends in 3Q, just slightly above the recovery average of 35.2 percent. The metric has had its share of ups and downs post-Great Recession, but the payout ratio is more or less stuck around one-third of operating earnings.

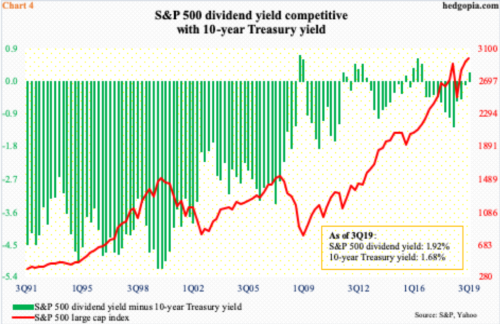

The dividend yield is going through the same dynamics. In 3Q this year, S&P 500 companies yielded 1.94 percent. In the prior 10 quarters, there has been only one quarter with yield of over two percent (Chart 3).

Except for a brief spike in 2008-2009, which was primarily due to the collapse in the S&P 500 large cap index, yield for the last 17 years has straddled around two percent. This is despite the steep growth in dividends. S&P 500 companies paid out $14.80/share in dividends in 3Q19, up from $3.90 in 3Q02. Yet, the yield is static. This is because of the massive rally in the index, which is used as the denominator in the equation.

The irony in all this is that despite the puny dividend yield, it still compares well with US sovereign yield. The 10-year Treasury yield ended 3Q at 1.68 percent. Rates have gone up since, with last Friday at 1.87 percent. This is still less than what S&P 500 companies are currently yielding. At the end of 3Q, these companies were obviously yielding much more than what 10-year notes were yielding. As Chart 4 shows, this does not usually occur.

Stocks in general are a risky asset, but because 10-year notes and 30-year bonds are not offering much in the way of yield, stocks are being bought for yield, putting upward pressure on the price. The S&P 500, which ended 3Q at 2977, ended last Friday at 3240.02.

Thanks for reading!