- FXE breaks one more crucial technical support

- Large speculators’ euro net shorts at 26-mo high, but flattish in recent weeks

- Market reaction to Draghi’s asset-purchase plans will be a tell regarding euro’s near-term direction

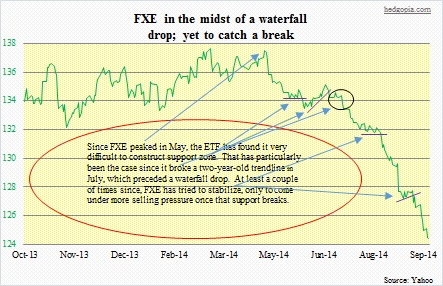

Still a wait-and-see on the euro (126.18). The currency is a classic example of what it is like trying to catch a falling knife. Since the FXE (124.38) peaked early May, the drop was more or less orderly, until when it fell out of a two-year-old wedge pattern in July (chart below). That was the first indication that sellers were simply overwhelming buyers, and also marked the beginning of what is turning out to be a waterfall drop. In the absence of support zone, price naturally gravitated toward the next best support – the 126-127 area. Now that is gone, too. Shows the absolute apathy toward this thing currently. Especially considering the ETF was not able to save the 126-127 level, this could very well be headed toward 118-120 if technicals rule. Medium- and short-term indicators are way oversold, but they have remained that way for a while now. Long-term indicators have a little bit more to go on the downside before they get to oversold conditions. It is possible that is what traders are waiting for. They have not found much to get excited about fundamentally anyway.

Still a wait-and-see on the euro (126.18). The currency is a classic example of what it is like trying to catch a falling knife. Since the FXE (124.38) peaked early May, the drop was more or less orderly, until when it fell out of a two-year-old wedge pattern in July (chart below). That was the first indication that sellers were simply overwhelming buyers, and also marked the beginning of what is turning out to be a waterfall drop. In the absence of support zone, price naturally gravitated toward the next best support – the 126-127 area. Now that is gone, too. Shows the absolute apathy toward this thing currently. Especially considering the ETF was not able to save the 126-127 level, this could very well be headed toward 118-120 if technicals rule. Medium- and short-term indicators are way oversold, but they have remained that way for a while now. Long-term indicators have a little bit more to go on the downside before they get to oversold conditions. It is possible that is what traders are waiting for. They have not found much to get excited about fundamentally anyway.

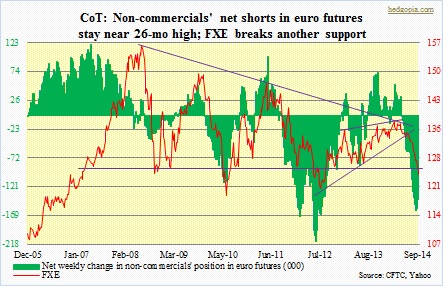

Of late, euro-zone economic data points have continued to come in on the weaker side. U.S. data have hung in there. The interest rate spread between the two continues to favor the U.S. dollar. This is not the only driver, though. In the last monthly meeting early September, the ECB cut interest rates further, and announced plans to purchase asset-backed securities and covered bonds. Since that meeting, pretty much all the economic data have been on the softer side. Annual inflation in September rose a mere 0.3 percent, slower than August’s 0.4 percent rise. Disinflation! Not what a debtor wants. There is not much maneuvering room on the interest-rate front. Other measures are needed. ECB president Mario Draghi will announce this morning details of his asset-purchase plans. How the market reacts to it will probably decide the fate of the euro, at least in the near-term. We will find out tomorrow how in the futures market large speculators were positioning themselves for the Draghi news. This is one group that has ridden the euro decline very well. Until last week, their net shorts in euro futures stood at two-year-plus highs. They have not been adding the last several weeks, but have not unloaded as well. They are probably all waiting to see what Draghi brings to the table. A short-covering reflex rally is possible, as is ‘sell the rumor, buy-the-news’. F/X traders on pins and needles!

Of late, euro-zone economic data points have continued to come in on the weaker side. U.S. data have hung in there. The interest rate spread between the two continues to favor the U.S. dollar. This is not the only driver, though. In the last monthly meeting early September, the ECB cut interest rates further, and announced plans to purchase asset-backed securities and covered bonds. Since that meeting, pretty much all the economic data have been on the softer side. Annual inflation in September rose a mere 0.3 percent, slower than August’s 0.4 percent rise. Disinflation! Not what a debtor wants. There is not much maneuvering room on the interest-rate front. Other measures are needed. ECB president Mario Draghi will announce this morning details of his asset-purchase plans. How the market reacts to it will probably decide the fate of the euro, at least in the near-term. We will find out tomorrow how in the futures market large speculators were positioning themselves for the Draghi news. This is one group that has ridden the euro decline very well. Until last week, their net shorts in euro futures stood at two-year-plus highs. They have not been adding the last several weeks, but have not unloaded as well. They are probably all waiting to see what Draghi brings to the table. A short-covering reflex rally is possible, as is ‘sell the rumor, buy-the-news’. F/X traders on pins and needles!