The Covid-19 pandemic disrupted the global economy ferociously the past several months, although several data points showed improvement in May, some of them substantially. US retail sales was one of them. Persistently elevated home prices must be helping consumer sentiment. It is worth remembering that home prices tend to peak in June and July, existing in particular.

In the early months this year, as the Covid-19 pandemic spread with alarming speed, the global economy essentially came to a standstill. Data all over fell off the cliff in February and March in particular. The US was no exception.

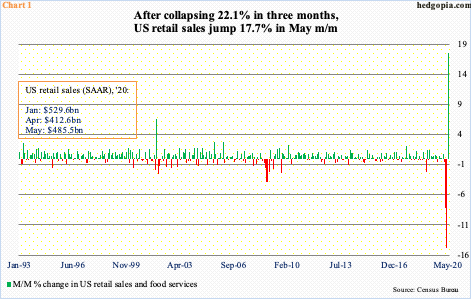

In January, US retail sales rose to a seasonally adjusted annual rate of $529.6 billion – a record. In February, they edged down 0.4 percent month-over-month. Then down came the sledgehammer. March was down 8.2 percent m/m, followed by a 14.8-percent collapse in April, to $412.6 billion. In three months, sales tumbled 22.1 percent.

Sales recovered in May – big time. They shot up 17.7 percent m/m (Chart 1). Equity bulls in particular are celebrating this as vindication that a V-shaped recovery is taking place in the economy. We will let time be the arbiter of that. In all probability, the May jump could just be due to pent-up demand. We just have to wait for more data for more clarity.

There is this, though. Both home and equity prices rank very high in how they impact consumer psyche. From the March lows, stocks have recovered phenomenally, and home prices are holding their ground at an elevated level.

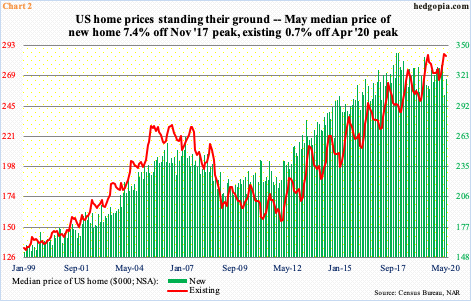

As with other macro data, home sales tumbled early this year. Existing homes hit 5.76 million units (SAAR) in February, before cratering to 3.91 million by May. New homes reached 774,000 units in January, dropped to 580,000 in April, before recovering to 676,000 in May. There has been a slight divergence between the two, but sales have weakened for both from their recent highs.

Despite this, the median price of an existing home reached a record high $286,700 in April, with May down 0.7 percent m/m to $284,600. For a new home, the median price was $317,900 in May, down 7.4 percent from the November 2017 record high of $343,400. Both have rallied massively from 2009-2012 lows.

Sales are weak, but supply is limited. In May, there was 4.8 months’ supply (not seasonally adjusted) in both new and existing homes. This has helped price stay elevated, which, in turn, helps buoy consumer sentiment.

With that said, in the past, home prices have shown a tendency to peak in June and July and bottom around January and February. This applies to existing homes in particular. Home prices are only one of the variables to impact consumer sentiment, but it is an important one, hence its potential significance in terms of consumer sentiment in months to come.

Thanks for reading!