- Gold continues to show improved price/volume action

- Not-so-good news on Swiss vote probably overcome by Dutch repatriation news

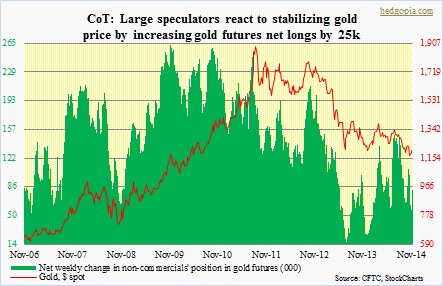

- Trend-following hedge funds added to net longs in gold futures, by both raising longs and cutting shorts

As suggested a week ago today, non-commercials did indeed add to their net longs in gold futures. They are now net long 81k contracts, up 25k week-over-week, and did so by both increasing longs and cutting shorts. More often than not, these large speculators tend to follow the prevailing trend. And on that front, action on the metal has improved. Price has risen for three consecutive weeks, with a pickup in volume to boot.

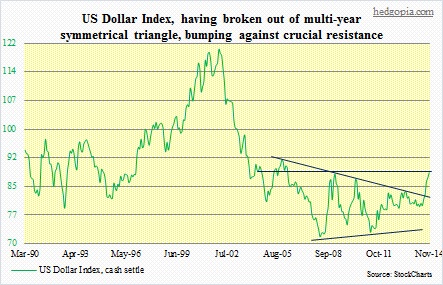

Importantly, both the dollar and gold rose last week. The U.S. Dollar Index has continued to find support at 87 (and change). For a sustained move higher for gold, the greenback probably needs to break that support. Momentum is intact, but technicals are way overbought – on all time frames. The index is currently sitting right underneath multi-year straight-line resistance. Near-term, it has gone sideways the past 12 sessions, giving bulls another opportunity to stage a breakout. Should that happen, it will be interesting to see how gold reacts. Will be a big tell.

The metal’s price action last week was encouraging also because mid-week the news hit that support for November 30th Swiss gold referendum was slipping. As that news was getting digested, it was revealed that the Dutch Central Bank recently repatriated 122 tons of gold from the New York Fed. Amidst all this, Gold has now stayed over the crucial 1,180 support for two weeks now. This, after having stayed underneath that for 10 consecutive sessions. Short-term notwithstanding, intermediate- and long-term technicals are way oversold, so there is room for the metal to run. It is now above its five-week moving average, which more often than not tends to signal a trend change. We shall see. More indications will probably come this week from, once again, the futures pit – whether or not non-commercials will continue to add to their net longs.

In a worse scenario, gold runs a risk of dropping toward 1,000-1,050. But for now, it is showing encouraging signs.