- Dollar index signaling it is ready to at least pause?

- Stronger $ will adversely impact both exports and earnings

- Fed can ill afford to send hawkish signal post-FOMC on Wednesday

Over the past three sessions, this is how the U.S. dollar index has traded. Thursday was a spinning top, Friday a shooting star, and Monday a strong open but a weak close. Yesterday was not a gap down, nor a long black candlestick, suggesting lack of bearish confirmation post-shooting star. But it is a black candlestick, just does not have ominous look to it.

As far as technicals go, this may be enough for traders to begin to expect some kind of pressure at least in the near-term. Yesterday, the dollar index rose 0.7 percent, as did the euro. That does not happen often. The euro is one of the six currencies that go into deciding the value of the index, and it makes up 57.6 percent.

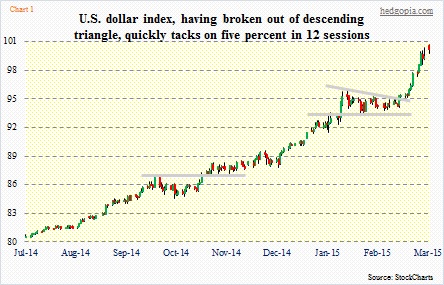

First of all, this is not the first time the index has shown signs of fatigue. For about a month beginning the third week of January, it went sideways, only to break out of a descending triangle it had carved out for itself (Chart 1). That breakout resulted in a quick five-plus percent rally – in a mere 12 sessions!

In fact, that gain equates to nearly half of the 10.5-percent rise year-to-date. Since July last year, it is up 25 percent. Evidently, the rate of change is accelerating. Of the last 45 weeks, it is up in 35. It has been up for eight consecutive months. March is halfway through, and is already up five percent. Anyway we cut it, these are astounding numbers.

So the question is, are we potentially looking at a pullback or just a pause that refreshes?

Considering that the index rose as high as 100.7 yesterday before pulling back, it is as good a spot as any to begin to digest gains. The 61.8-percent Fibonacci retracement of the July 2001-April 2008 decline lies at 102.2.

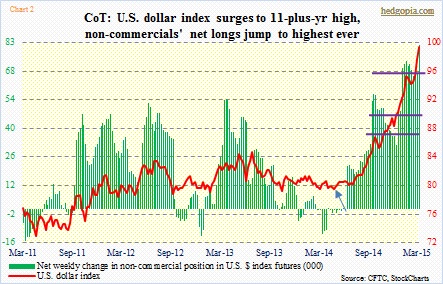

However, large speculators are not positioning themselves for a pullback. As of last Tuesday, they held 81k net longs in U.S. $ index futures (Chart 2). They deserve the benefit of the doubt, as they have ridden this thing so well since the middle of last year. With that said, this is also a group that tends to do very well in the middle of a trend but not so much at inflection points.

The bigger question to ask perhaps is this. If these specs are right, (1) what would that do to U.S. exports as well as earnings of multinationals in particular, and (2) is there a chance the Fed feels the need to step in?

As the greenback’s rip-roaring rally continues, Chart 3 increasingly takes on added importance. The share of exports in U.S. nominal GDP is already well above average. It peaked in 3Q11 at 13.7 percent, and has since dropped 50 basis points. Not much in the big scheme of things. However, the dollar index troughed in May of that year (blue arrow in Chart 2; looks a little different as it uses closing price). The real spike came in the second half last year. In all probability, its full impact is yet to be felt across U.S. exports. If the buck rises further, it is only a matter of time before exporters cry uncle.

Then we have the Fed, whose policy mandate includes inflation and employment, but not currency. Nonetheless, movement in the dollar can impact both. Strong dollar puts downward pressure on inflation. And since exports can be adversely impacted, this always entails a risk of job loss.

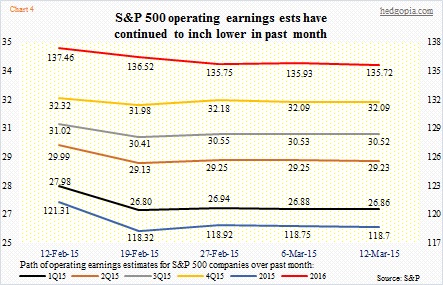

We need go no further than take a look at earnings estimates. First off, just about the time oil peaked in the middle of last year, the sell-side was expecting $137.50 in operating earnings for S&P 500 companies. As did the price of oil, those lofty expectations have come crashing down to earth. They were $121.31 on February 12 (Chart 4). A month later, they were $118.70. The trend of downward revision applies to both 2015 and 2016, as well as all four quarters of 2015. It is beginning to feel like the analysts are just now beginning to catch up with the dollar’s relentless rally and its impact on earnings.

In the midst of all this, the Fed has been signaling that a rate hike is imminent, painting itself into a corner. If that hike-this-year signal is reiterated post-FOMC meeting on Wednesday – not a base case – it is a high-five time for large specs.