- FXI is caught between weak macro backdrop, the Chinese government’s unwillingness to open up stimulus wallet, and deteriorating technical conditions. There is probably more to go on the downside.

It has been a month and a half since we last discussed Chinese stocks. As an academic exercise, the August 6th blog suggested a risk-reversal trade, selling Sep14 40 calls on the FXI for $1.37 each and using the proceeds to purchase Oct14 40 puts for $1.25 each. The trade could not have unfolded any better. The calls have expired, now the puts are in play. The ETF (39.12) has been under tremendous selling pressure lately. In all probability, there is more to go on the downside. Short-term technical conditions are oversold, so a reflex rally is always possible. But medium-term indicators, which have moved lower and are approaching the middle of the range, might just win out in the near-term. To refresh memory, early July, the ETF staged a breakout, with the VXFXI, its volatility, dropping to 16.93. The FXI then quickly shifted into a rally mode, but volatility hung in there. This divergence was in play one more time. The ETF did manage to trade north of $42 early this month, with volatility only dropping to 17.33 late August. Here is a telltale sign: the prevailing weakness in Chinese stocks has come in the midst of liquidity injection by the People’s Bank of China. Last week, news came out that the PBoC was injecting 500bn yuan into the country’s five major state-owned banks. The mini-stimulus came on the heels of a barrage of disappointing economic data. August saw year-over-year growth in industrial production dropping to a six-year low, and foreign direct investment hit a four-year low. Demand for loans from businesses are sagging. Credit growth has tight correlation with housing, which is sputtering. Retail sales and fixed asset investment are seeing weakness.

It has been a month and a half since we last discussed Chinese stocks. As an academic exercise, the August 6th blog suggested a risk-reversal trade, selling Sep14 40 calls on the FXI for $1.37 each and using the proceeds to purchase Oct14 40 puts for $1.25 each. The trade could not have unfolded any better. The calls have expired, now the puts are in play. The ETF (39.12) has been under tremendous selling pressure lately. In all probability, there is more to go on the downside. Short-term technical conditions are oversold, so a reflex rally is always possible. But medium-term indicators, which have moved lower and are approaching the middle of the range, might just win out in the near-term. To refresh memory, early July, the ETF staged a breakout, with the VXFXI, its volatility, dropping to 16.93. The FXI then quickly shifted into a rally mode, but volatility hung in there. This divergence was in play one more time. The ETF did manage to trade north of $42 early this month, with volatility only dropping to 17.33 late August. Here is a telltale sign: the prevailing weakness in Chinese stocks has come in the midst of liquidity injection by the People’s Bank of China. Last week, news came out that the PBoC was injecting 500bn yuan into the country’s five major state-owned banks. The mini-stimulus came on the heels of a barrage of disappointing economic data. August saw year-over-year growth in industrial production dropping to a six-year low, and foreign direct investment hit a four-year low. Demand for loans from businesses are sagging. Credit growth has tight correlation with housing, which is sputtering. Retail sales and fixed asset investment are seeing weakness.

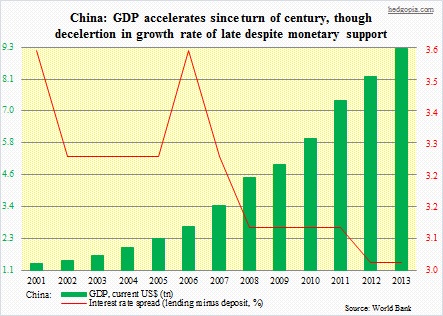

Investors are hoping the authorities will end up throwing boatloads of money at the slowdown. We have seen this movie before. Back in 2012 and 2013, growth decelerated in 1Q, followed by stimulus announcement. Again early this year, growth decelerated, and the government eased up on fiscal and monetary policy. Data improved for a few months and stalled again. As this jugglery continues, increasingly it is taking more debt to generate the same amount of GDP. To be clear, the country continues to grow at a very healthy rate, but the growth rate (real) has been decelerating – from 9.2 percent in 2009 to 10.4 percent in 2010 to 9.3 percent in 2011 to 7.7 percent in both 2012 and 2013. In the markets, emphasis is given more to the relative, not the absolute. The IMF projects 7.4 percent growth in real GDP this year, slowing down to 7.1 percent next year. The latter forecast is revealing given its global forecast of 3.4 percent and four percent, respectively. And it does not look like more stimulus is in the cards, no matter how transitory its effect. Over the weekend, the Chinese finance minister implied that a major stimulus program might not be forthcoming. This is not what investors who bought the early-March bottom (in the FXI) were hoping for. The ETF went on to rally 33 percent in the next six months. There is tons of paper profit still left in this thing. Now that the trend has reversed, in-profit positions will increasingly come under pressure to lock it in.

Investors are hoping the authorities will end up throwing boatloads of money at the slowdown. We have seen this movie before. Back in 2012 and 2013, growth decelerated in 1Q, followed by stimulus announcement. Again early this year, growth decelerated, and the government eased up on fiscal and monetary policy. Data improved for a few months and stalled again. As this jugglery continues, increasingly it is taking more debt to generate the same amount of GDP. To be clear, the country continues to grow at a very healthy rate, but the growth rate (real) has been decelerating – from 9.2 percent in 2009 to 10.4 percent in 2010 to 9.3 percent in 2011 to 7.7 percent in both 2012 and 2013. In the markets, emphasis is given more to the relative, not the absolute. The IMF projects 7.4 percent growth in real GDP this year, slowing down to 7.1 percent next year. The latter forecast is revealing given its global forecast of 3.4 percent and four percent, respectively. And it does not look like more stimulus is in the cards, no matter how transitory its effect. Over the weekend, the Chinese finance minister implied that a major stimulus program might not be forthcoming. This is not what investors who bought the early-March bottom (in the FXI) were hoping for. The ETF went on to rally 33 percent in the next six months. There is tons of paper profit still left in this thing. Now that the trend has reversed, in-profit positions will increasingly come under pressure to lock it in.