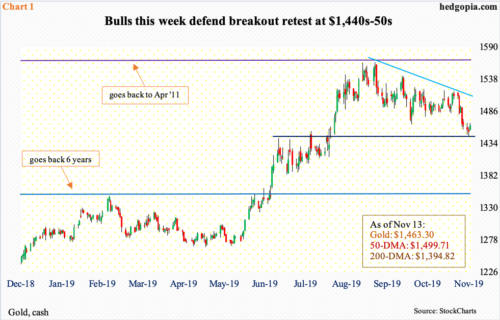

In two-plus months, gold dropped just shy of eight percent. With two more sessions to go this week, bulls have managed to defend $1,440s-50s. Rally odds have gone up near term.

Gold bugs are putting their foot down. This week’s intraday low of $1,446.20 represents breakout retest of $1,440s-50s, which gold broke out of early August (Chart 1). Post-breakout, the metal rallied to $1,566.20, before hitting a roadblock. Resistance around that price point goes back to April 2011.

Once rejected at that ceiling, in a little over two months, gold ($1,463.30/ounce) proceeded to shed 7.7 percent. The daily in particular has been pushed into oversold territory, raising the odds of unwinding – at least near term. Hence the significance of whether or not bulls will be able to defend the aforementioned breakout retest. So far, so good.

The road ahead is not without pitfalls. Immediately ahead, there is resistance at $1,480s, which is where shorter-term moving averages converge. Both the 10- and 20-day are pointing down. As is the 50-day ($1,499.71). So, the best-case scenario for bulls is more sideways action near term. In due course, they need to recapture a falling trend line from the aforementioned September high (Chart 1) around $1,510, which then opens the door to a test of that high, which also approximates Fibonacci resistance.

The metal peaked in September 2011 at $1,923.70. It then came under severe pressure after losing $1,550s (black horizontal line in Chart 2). By December 2015, gold tagged $1,045.40. Encouragingly for bulls, the metal has set a pattern of higher lows since that trough. At the same time, at $1,588.19 lies 61.8-percent retracement of the four-year decline. Fibonacci followers tend to pay close attention to this level. The September high of $1,566.20 just about fulfilled that retracement (chart uses monthly close, hence does not quite reflect this).

Bulls are obviously hoping to go attack that resistance again. For that, they needed to defend $1,440s-50s, which they have done. Odds of a rally near term have grown. How things evolve in the next several sessions potentially gives us clues as to how far the rally goes.

Thanks for reading!