Gold is regaining its lost luster. Last week, it staged what could turn out to be a major breakout. If genuine, the metal in due course could head toward retracing 61.8 percent of the September 2011-December 2015 decline.

Gold ($1,400.10) has gone parabolic in the past month – sort of. For a month through the third week of May, gold bugs defended $1,260s several times (Chart 1). Since that low through last Friday’s intraday high of $1,415.40, the metal jumped north of 11 percent – not only past the now-rising 50-day moving average but also crucial resistance at $1,350s-1,360s. Gold has been range-bound particularly the past six years.

The yellow metal peaked in September 2011 at $1,923.70. Nearly six years went by before it bottomed in December 2015 at $1,045.40. Since that low, gold has made higher lows, but the afore-mentioned ceiling came in the way time and time again – until last week.

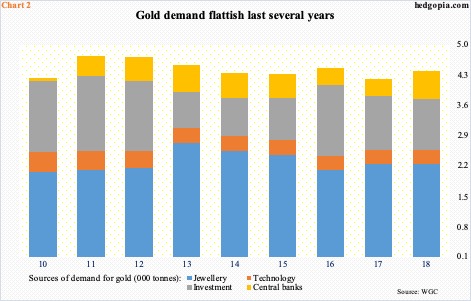

The physical gold has not seen a sudden increase in demand. The World Gold Council breaks down gold demand into four major categories – jewellery, technology, investment, and central banks. In 2018, overall demand rose 4.8 percent to 4,399 tonnes, essentially tying with the 2014 total of 4,357 tonnes (Chart 2). In fact, demand was as high as 4,748 tonnes in 2011.

Curiously, central banks played a major role last year, demanding 657 tonnes, versus 377 tonnes in 2017. Last year, these banks made up 15 percent of the total. They have been adding to their gold reserves.

Also last week, central banks played a major role in gold’s breakout. Both the ECB and the Fed delivered dovish messages. Tuesday, Mario Draghi, ECB president, said if inflation failed to pick up, more policy easing could be on the way. Wednesday, at the conclusion of a two-day FOMC meeting, Jerome Powell, Fed chair, seemed to have opened the door for possible easing.

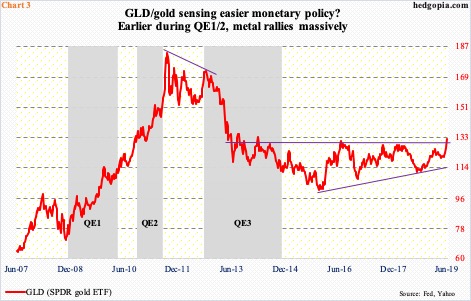

Major central banks’ conventional monetary quiver does not have sufficient arrows. The fed funds rate is at a range of 225 to 250 basis points. The ECB’s benchmark refinancing rate is at zero percent and the deposit rate at negative 40 basis points. Should there be a need for aggressive easing, they will have no option than to resort to unconventional policy. This is what gold is beginning to sense.

Chart 3 shows how GLD (SPDR gold ETF) shot up during the first two iterations of US quantitative easing post-financial crisis.

Thus far, the Fed is following markets’ lead. Rate expectations have done quite a U-Turn. Not too long ago, the Fed was preparing markets for a couple more hikes this year. In 2018, rates went up three times. Now, it is just a matter of how many cuts lie ahead and over what time period. Fed funds futures have aggressively priced in two 25-basis-point cuts – one each in July and September – and maybe one more in December.

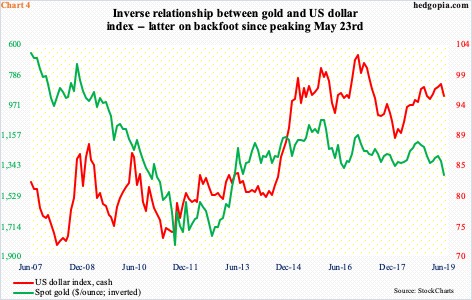

This is beginning to impact the currency market as well. Last week, the US dollar index dropped 1.4 percent, while the euro rallied 1.1 percent. Even before the Fed’s dovish shift last week, the index’s weekly momentum indicators were already in the process of unwinding overbought condition. Tuesday, it got rejected at the 50-day, followed by sizable red candles in each of the remaining three sessions. The 200-day has been lost. Ditto with a rising trend line from last September. Support lies just north of 95 – a must-save. A breach should help gold, which tends to have an inverse relationship with the US dollar (Chart 4).

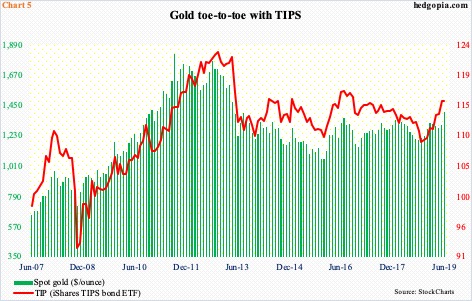

The Fed would like to depress real yields to boost the economy. At least in theory, this can put downward pressure on the greenback, which, in turn, can put upward pressure on inflation. Gold can be used as a hedge in this scenario.

Real rates can be calculated as a difference between Treasury yields and annual CPI. Alternatively, the US government now issues TIPS (Treasury Inflation-Protected Securities). These are bonds indexed to inflation; the principal rises as inflation rises. Most recently, TIP (iShares TIPS bond ETF) bottomed last November at $107.53 and closed out last week at $115.32. Gold is moving in tandem (Chart 5).

What could potentially throw a monkey wrench into all this?

Should inflation pick up steam in an unexpected manner, rates can rise. In this scenario, the dollar can rally as well. But then again, should the Fed choose to let inflation run a little stronger than its current two-percent objective, this becomes a moot issue. Of its dual mandate – maximum employment and price stability – jobs have been plentiful post-Great Recession but inflation in general remains sub-par. Should things evolve this way, low rates will combine with high inflation – a perfect scenario for gold. The way the metal is acting, traders are beginning to position for this.

As explained earlier, the metal broke out of important resistance last week. Concurrently, it also surpassed a 38.2-percent Fibonacci retracement of the September 2011-December 2015 decline. Chart 6 also shows a potentially bullish crossover between 10- and 40-month averages. In due course, gold could very well be headed toward retracing 61.8 percent of that decline, which lies at $1,588.

Near term, the daily is overbought. In a perfect scenario, gold pulls back to retest the breakout and there will be buyers waiting to push the metal still higher.

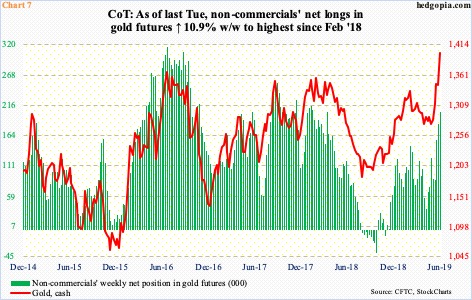

Non-commercials are positioned for this. As of last Tuesday, net longs in gold futures rose 10.9 percent week-over-week to 204,323 contracts. This was the highest total since February last year (Chart 7). Only two months ago, these traders were net long 37,395 contracts. Their aggression has paid off.

Of late, flows are in cooperation as well. In the week to last Wednesday, GLD (SPDR gold ETF) took in $189 million and IAU (iShares gold trust) $269 million (courtesy of ETF.com). This was IAU’s first positive week in 10, with the prior nine losing $849 million. In the past five, GLD gained $1.3 billion.

If gold indeed pulls back near term, it will be interesting to watch how ETF flows and non-commercials behave. Ideally, when a breakout retest occurs, those that missed the earlier rally should get tempted to jump onboard.

Thanks for reading!