- In wake of early September breakout, U.S. dollar in limbo

- Too soon to say if breakout is reversal or continuation of prior downward trend

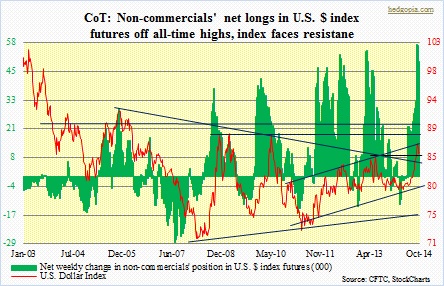

- Sentiment too bullish, reflected in large speculators’ futures position, raising odds of mean reversion

The U.S. dollar is caught in a limbo. The U.S. Dollar Index had a major break out of a nine-year triangle early last month and has since lost momentum. Sort of. It is not yet clear if the breakout is a reversal or continuation pattern of the prior trend, which was down. Needless to say, each carries huge macro repercussions.

Wolfgang Schauble, German finance minister, admitted lower euro was helping German exports. Japan would like a lower yen so exports get a boost. The Asian nation desperately needs current account surplus. For a country as indebted as it is, the lesser the amount of debt sold to foreigners the better. South Korea recently cut interest rates. It is another export powerhouse. A lower won helps. Competitive devaluation is a popular tool these days. Recently, we heard a few Fed officials opine that the dollar may be a little too strong. Besides hurting exports, imports get cheaper, which has the potential to import disinflation/deflation. The Fed does not like that. Point is, as a reserve currency the dollar’s influence can be felt across economies, asset classes, and what not. Already here at home, we are beginning to hear how a rising dollar would negatively impact the businesses of multinationals. S&P 500 companies draw nearly half of their revenues and profits from overseas.

So where to from here? The currency could simply be taking a breather. So far, the 84.50-85 support has held. Short-term technical indicators are oversold, so a bounce looks imminent. Nevertheless, post-breakout action could very well be suggesting at least a test of that breakout, which lies around 83.70. Odds have grown particularly given the current sentiment. Until four weeks ago, large speculators held the most net longs in U.S. $ index futures. They have since reduced their exposure by 8k contracts, but still very high historically. Mean reversion, anyone?