Info tech has become a favorite this year. Bulls have turned a blind eye to several metrics including the sector’s contribution to S&P 500 earnings being much smaller than its share of market cap.

Information technology has been a go-to sector this year. The Nasdaq Composite is up 16.2 percent so far this year and the more-concentrated Nasdaq 100 is up 19.8 percent. From last October’s lows, they are up even more – respectively up 20.6 percent and 25.6 percent.

On the way to that low, the Nasdaq 100 lost 12800s last August, after having tagged 13721 earlier that month. At the end of March (this year), the level was recaptured. Since then, there have been several successful retests, including this week.

Continued defense of 12800s can open the door toward the upper end of a months-long rising channel – currently at 13700s, which matches last August’s high 13721 (Chart 1).

Tech obviously is a leading sector and accordingly has an inordinate influence on several market cap-based equity indices.

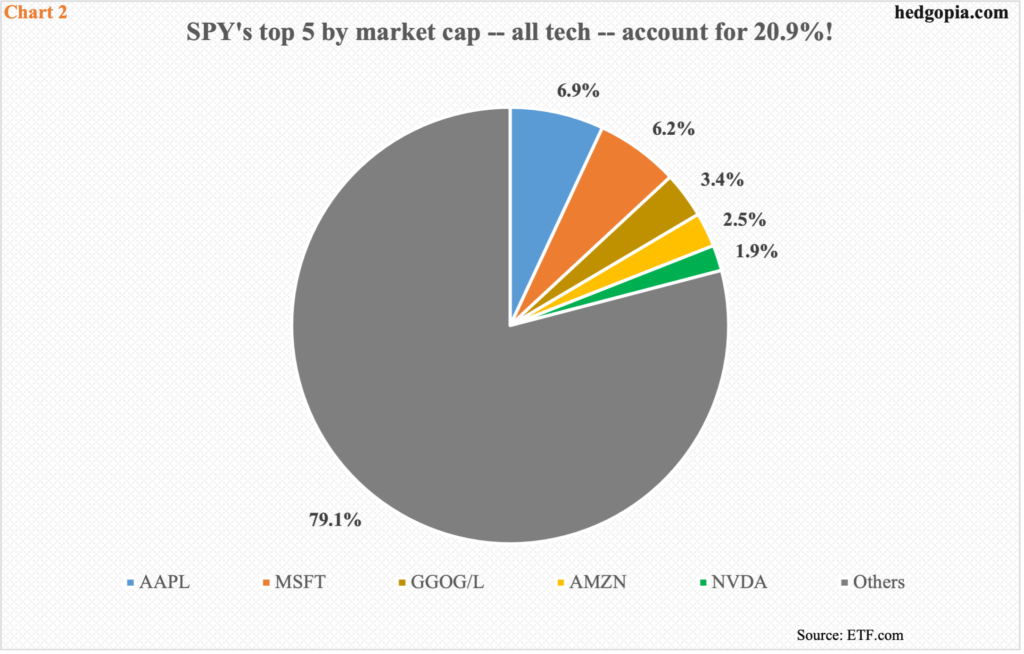

In SPY (SPDR S&P 500 ETF), the top five weights are all tech – Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG/L), Amazon (AMZN) and Nvidia (NVDA). Together, they currently account for 20.9 percent of the ETF/S&P 500 large cap index (Chart 2).

Interestingly this year, tech bulls have wanted to own the sector, even though it is getting more expensive to do so.

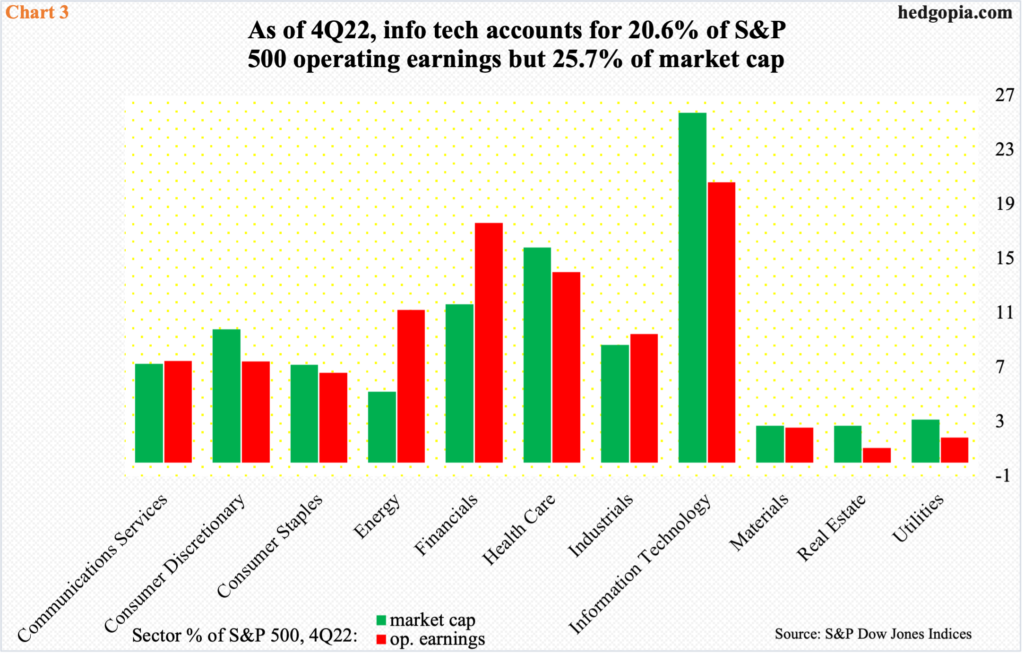

At the end of 2022, of the 11 sectors within the S&P 500, information technology had a market value of $8.3 trillion, with health care distant second at $5.1 trillion. Overall, the S&P 500 had a market value of $32.1 trillion, meaning tech accounted for 25.7 percent. Of S&P 500 operating earnings, however, the sector only accounted for 20.6 percent (Chart 3).

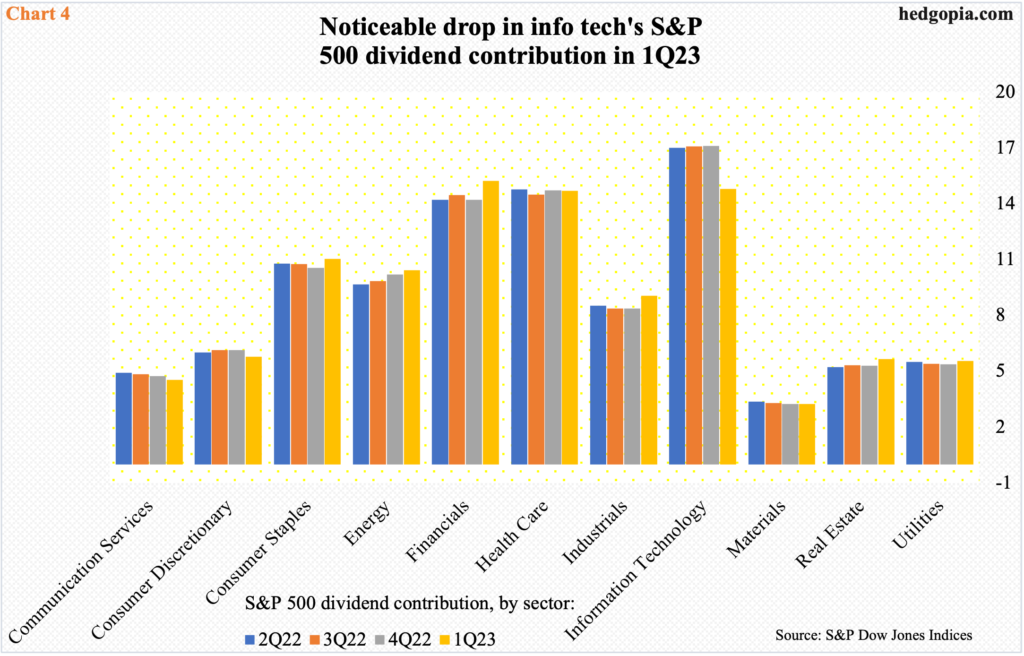

This now also applies to dividends.

For several quarters leading to 1Q23, info tech contributed around 17 percent of S&P 500 dividends. Last quarter, this dropped at 14.8 percent (Chart 4).

The bottom line is that the sector has become a favorite this year, but not all related metrics are on board.

Thanks for reading!