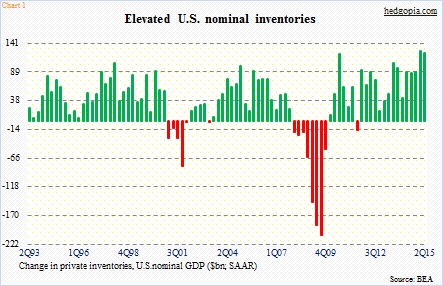

In the second-quarter advance estimate for U.S. GDP released yesterday, one of the things that jumped out was the level of inventories.

Private businesses accumulated $124 billion in nominal inventories. In 1Q15, these were $127.3 billion (Chart 1); 1Q15 was originally reported as $105.8 billion. In fact, for 10 out of the 13 quarters going back to 1Q12, inventories were revised higher, including the last four.

As a percent of nominal GDP, inventories made up 0.7 percent in both the first and second quarters this year. This has steadily increased over time – from 0.1 percent in 4Q12.

This is a potential drag on the economy in the out quarters.

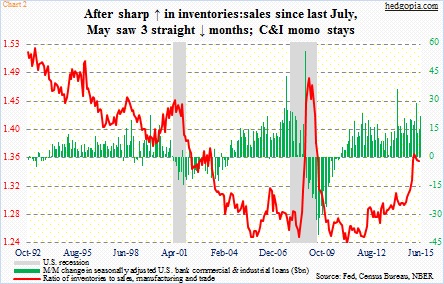

The inventory situation depicted by the GDP report jives with the message coming out of Chart 2.

The red line in the chart is a ratio of inventories to sales in manufacturing and trade. In May, inventories were $1.8 trillion and sales $1.3 trillion, for a ratio of 1.358. In the current cycle, it bottomed at 1.24 in March 2011, but began to particularly spike beginning July last year, when the ratio stood at 1.294. The good thing is, the ratio peaked in February at 1.368, and has had three monthly declines since.

The spike in the ratio in Chart 2 has been accompanied by a steady rise in U.S. banks’ commercial & industrial loans. In June, they were $1.9 trillion, up $209 billion year-over-year.

Inventory accumulation occurred as growth expectations came up short. Last year – even early this year – many economists were forecasting real GDP this year to accelerate to three percent or higher. Currently, the consensus is 2.2 percent. The much-hoped-for escape velocity is yet to occur.

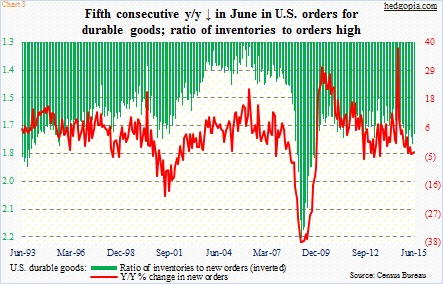

Up until June, the trend has anything but improved.

Chart 3 lays out orders and inventories for durable goods. The picture is not pretty. Orders peaked at just under $300 billion last July, though that high was more of an outlier; June was just north of $235 billion. Year-over-year, orders have dropped for five consecutive months, and for seven out of eight months. Inventories, on the other hand, were north of $402 billion in June – a record. The inventories-to-sales ratio peaked at 1.78 in February, and has been declining, but not enough. Orders are weak and inventories high. Never a good mix.

For the third and fourth quarters this year, the consensus expects 3.1 percent and three percent real GDP growth. Realistic or optimistic? The level of inventories sitting out there suggests the latter.

Thanks for reading!