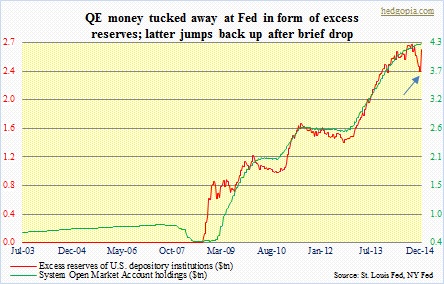

One of the perplexing things in the current economic cycle has been the suppressed velocity of money. Six years into recovery, velocity has yet to pick up steam. As the chart below shows, excess reserves have gone toe-to-toe with the Fed’s balance sheet. Reserves have swollen, earning interest. So when beginning early September, they began to drop ahead of QE3-end, there was a lot of chatter about maybe the banks are finally beginning to lend. Reserves indeed dropped $363bn in three months (blue arrow in the chart below). Well, it seems that the drop was one-off. Reserves have gone back up – up $300bn from that low. They are yet to start hitting the economy.

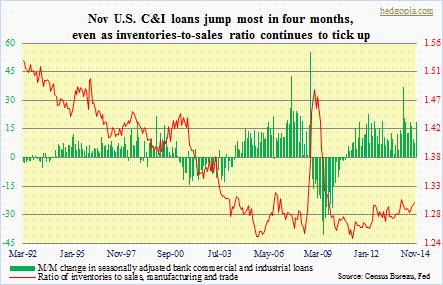

If there is any solace in all this, it is that banks’ commercial and industrial loans did pick up the pace in November. (The reserves data is as of the 24th this month.) Month-over-month, they were up $18bn. Definitely positive. This would look even better if that red line in the chart below would stop rising. That is the ratio of inventories to sales. And in keeping with the rise in inventories elsewhere, it is trending higher. So let us not pop the champagne just yet.

Happy New Year 2015!