Yesterday came news that U.S.-based funds attracted $36.5bn in stock inflows in the week ended December 24 (courtesy of Thomson Reuters Lipper Service).

Some thoughts on this:

1. The inflows are simply massive. There is no other way to describe it. They are the biggest since Lipper began collecting data in 1992. Rather revealingly, $39bn went into U.S. stocks, even as $2.5bn was yanked out of non-U.S. funds. In an environment in which the dollar is trending higher and there is talk of the Fed tightening next year, ‘overseas’ gets no love. The U.S. is cherished.

2. The overall inflows into stock funds follows $17.9bn in withdrawals the prior week, which were the biggest since February. Now we know why stocks were weak in the second week of this month. The latest inflows also explain the reason why stocks surged on the 17th and 18th. The S&P 500 was up 4.5 percent in those two sessions.

3. Stock mutual funds attracted $12.8bn, and ETFs $23.7bn. And then this from Lipper: “The inflows into stock mutual funds were the biggest since March 2000, while the inflows into stock ETFs were the biggest since March 2008.” In 2000, stocks peaked in that month. In 2008, stocks took a breather in March following the October 2007 peak. New money piled in thinking the bottom was in. It was not.

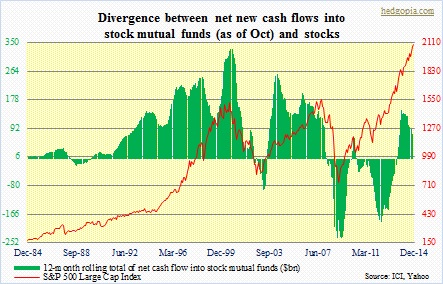

4. Using ICI data, the chart below shows the divergence between stocks and flows into mutual funds. Flows are as of October. One reason behind the divergence is simple. ETFs have taken off. Assets have surged to $1.9tn (as of October). Of this, $1.2tn is domestic equity. As the Lipper data above shows, nearly two-thirds of the new money that went into stocks in the latest week went into ETFs, which the chart is not going to capture. This partly explains the divergence. Then again, the picture will now look different as December data is reported. Flows would have caught up with the rise in stocks.

5. Not sure if the latest inflows into U.S. stocks smacks of euphoric sentiment, but it should rank pretty high up there. The math is simple. As long as there is a buyer who is willing to buy it from you, the game goes on. When in January last year Jeff Gundlach made a now famously contrarian bearish call on AAPL, he was asking, who is left to buy it? So the question is, would the latest inflows act as a self-fulfilling prophecy and end up drawing in more money or is it the last hurrah? Not trying to be an alarmist, but history is full of Johnny-come-latelies left holding the bag.