The Nasdaq Composite and Nasdaq 100 are at new highs, but their A-D lines are acting different – in confirmation with the latter but not the former. Once again, it is a case of the soldiers not falling in line with the generals.

Tech is leading – again. The Nasdaq Composite posted a fresh high on Wednesday, ticking 15059, with a mini breakout on Monday. For the year, it is up 16.5 percent. With four more sessions to go, August so far is up 2.4 percent; if this holds, this will represent a ninth positive month in the last 10 and 14th in the last 17. The bottom line: tech has momentum.

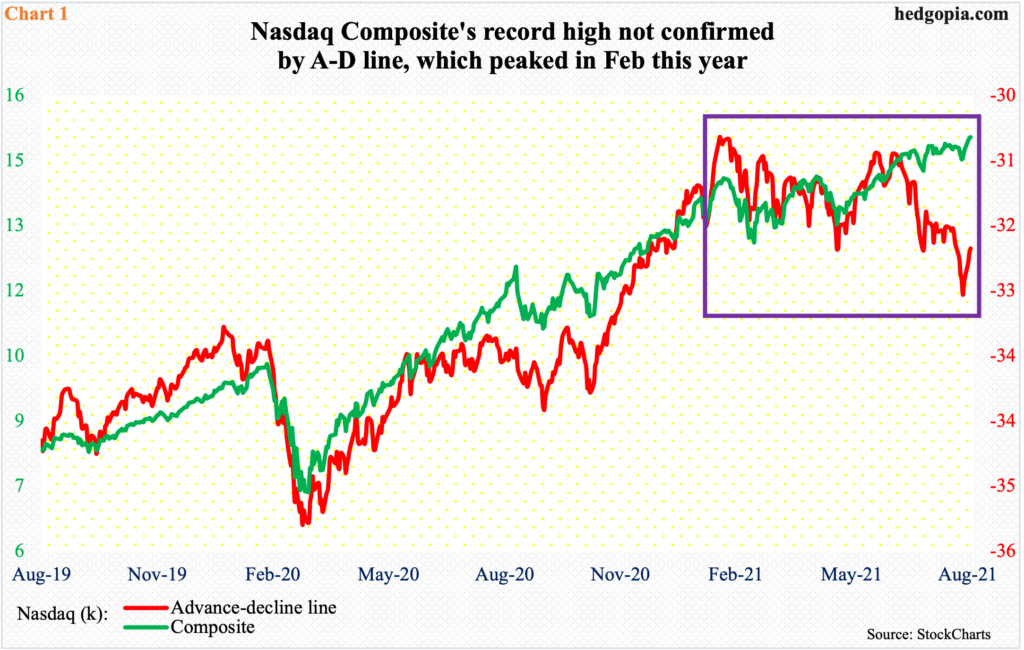

Behind this strength lurks non-confirmation from the advance-decline line, which peaked as far back as February this year. After that peak, both the Composite and the A-D line went hand in hand until early July, when the latter decidedly trended lower even as the former trudged higher (Chart 1).

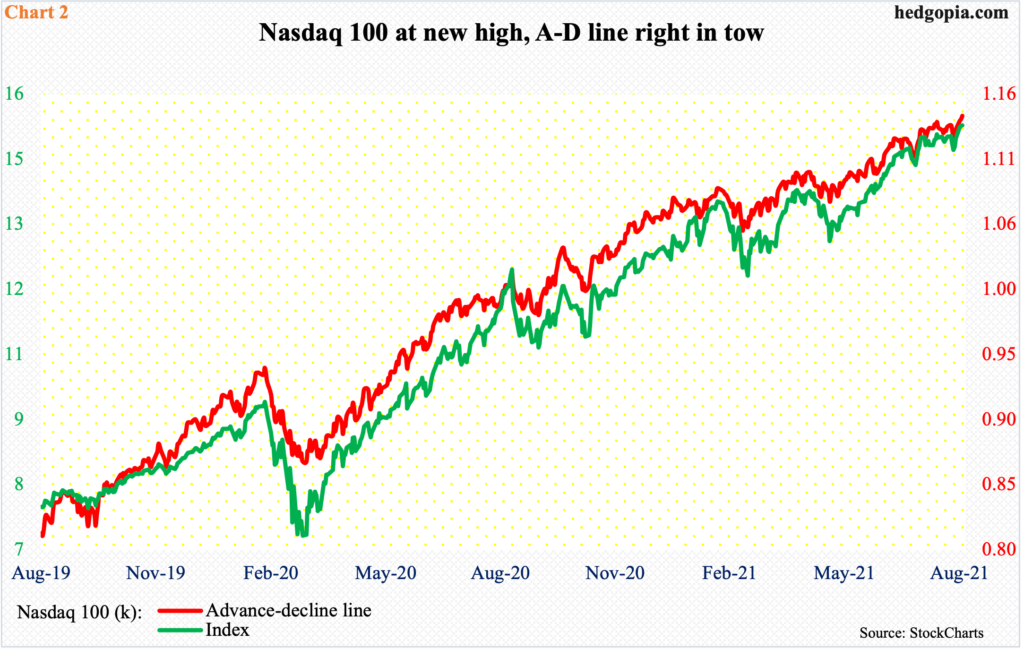

The picture looks a whole lot different if we look at a narrower subset within the Composite. The Nasdaq 100, which includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq, also rose to a fresh high on Wednesday, tagging 15369. As did the Composite, it, too, enjoyed a mini breakout on Monday. But unlike its bigger cousin, the Nasdaq 100 has cooperation from its A-D line, which, too, rose to a new high on Wednesday (Chart 2).

Large-caps are ruling – be it in tech or elsewhere. The S&P 500 large cap index notched a new high on Wednesday, but both the S&P 400 mid cap index and S&P 600 small cap index are below their May and June highs respectively.

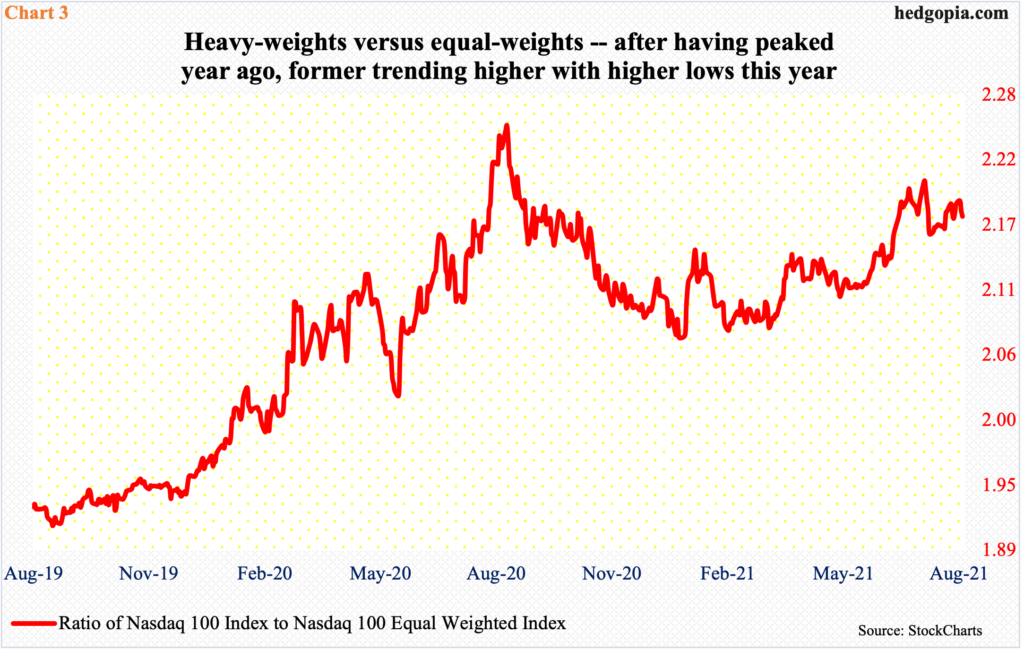

Even within large-cap tech, a ratio of the Nasdaq 100 to the Nasdaq 100 equal weighted index has been trending higher with higher lows throughout this year. Both these indices are at new highs, but on a relative basis the former has been faring better for several months now.

The ratio between the two peaked a year ago, meaning the ones with bigger market caps then began to lag. This ended last November, with higher lows since (Chart 3). As things stand, the heavy-weights within the Nasdaq 100 continue to lead.

The top five – Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Google owner Alphabet (GOOG) and Facebook (FB) – combined account for 41 percent of the Nasdaq 100. This is too lop-sided. But at the same time, the A-D line is in confirmation. A divergence will raise a red flag, as it will have confirmed the ongoing non-confirmation within the Nasdaq Composite.

Thanks for reading!