One of the divergences we have witnessed in recent weeks/months is weak action in small-caps. The Russell 2000 Small Cap Index peaked early March, then suffered a nine-week, 11-percent decline, followed by a rally beginning mid-May. The index still trades below that early-March high. Comparatively, the S&P 500 Large Cap Index is four percent higher than its early-March level. Toward the middle of that month, the RUT broke down, falling out of a two-year-old channel, thus precipitating the decline. Whenever a breakdown of this significance occurs, it takes time to repair the damage. Until that happens, technically oriented traders shy away from aggressively building positions. If the index trades exactly like a textbook would tell us, it is supposed to find resistance at the lower end of the channel it was in. That would mean there is room for an additional two-percent rally from here, which by default would also amount to a test of that early-March high. If things pan out this way, then by that time the index will once again get into overbought conditions. The March-May decline had pushed the index into oversold conditions, a lot of which has now been unwound. So the odds of the index failing the test of early-March high – should that happen at all – have greatly risen.

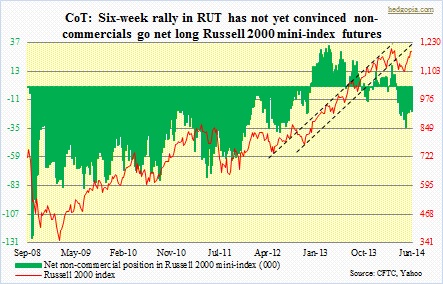

This is also the message coming out of the futures pit. Non-commercial traders are currently net short Russell 2000 mini-index futures, but there is not a whole lot of change versus a few weeks ago in how they are positioned. They went net short early April, hence managed to catch most of that March-May decline. They were net short 23k contracts mid-May and 21k contracts in the latest week – not much change even as the RUT has rallied 10 percent from mid-May low. As a matter of fact, since mid-May large speculators have raised longs by 10k and shorts by 8k, hence not willing to aggressively go net long. In other words, they are not entirely convinced by the ongoing six-week rally in the index. Guess is, they are waiting for either a failure of that afore-mentioned test or signs of distribution before getting aggressive on the short side.

This is also the message coming out of the futures pit. Non-commercial traders are currently net short Russell 2000 mini-index futures, but there is not a whole lot of change versus a few weeks ago in how they are positioned. They went net short early April, hence managed to catch most of that March-May decline. They were net short 23k contracts mid-May and 21k contracts in the latest week – not much change even as the RUT has rallied 10 percent from mid-May low. As a matter of fact, since mid-May large speculators have raised longs by 10k and shorts by 8k, hence not willing to aggressively go net long. In other words, they are not entirely convinced by the ongoing six-week rally in the index. Guess is, they are waiting for either a failure of that afore-mentioned test or signs of distribution before getting aggressive on the short side.