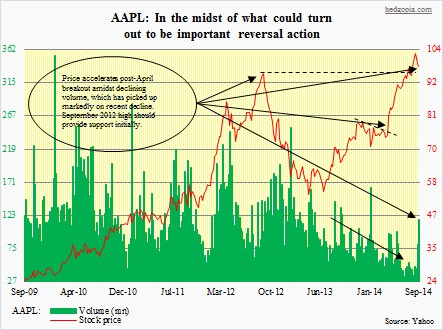

Investors have spoken. Bring up yesterday’s daily chart on AAPL ($97.99), and it is all there to see. Two o’ clock was when sentiment shifted. Post-announcement of products in Cupertino, bulls valiantly rallied the stock nearly five points, seeking to take out last week’s high, only to soon run out of air. By the close, the session produced a high-volume reversal day, which we are likely to remember for a long time to come. We saw an inkling of things to come last week when bears successfully carved out a bearish engulfing candle. The action yesterday more or less confirms that action. There are three more sessions left in the week, so plenty can happen to negate the bearish action. But that is probably asking too much of the stock. In two years, AAPL has exactly done a round trip and then some – from split-adjusted $96.21 on September 4, 2012 to $53.10 on April 1, 2013 to $103.74 on the 2nd this month. The stock particularly took off in April this year after it broke out of a five-month sideways pattern. In short, there was a lot of optimism already built into the event yesterday. Be that as it may, this alone is not a reason for a selloff. If AAPL the company was able to convince the market that the announced products carried more top- and bottom-line prospects than already priced in, not only would existing investors sit tight but would probably attract new money. In investors’ eyes, the company did not hit it out of the park.

Investors have spoken. Bring up yesterday’s daily chart on AAPL ($97.99), and it is all there to see. Two o’ clock was when sentiment shifted. Post-announcement of products in Cupertino, bulls valiantly rallied the stock nearly five points, seeking to take out last week’s high, only to soon run out of air. By the close, the session produced a high-volume reversal day, which we are likely to remember for a long time to come. We saw an inkling of things to come last week when bears successfully carved out a bearish engulfing candle. The action yesterday more or less confirms that action. There are three more sessions left in the week, so plenty can happen to negate the bearish action. But that is probably asking too much of the stock. In two years, AAPL has exactly done a round trip and then some – from split-adjusted $96.21 on September 4, 2012 to $53.10 on April 1, 2013 to $103.74 on the 2nd this month. The stock particularly took off in April this year after it broke out of a five-month sideways pattern. In short, there was a lot of optimism already built into the event yesterday. Be that as it may, this alone is not a reason for a selloff. If AAPL the company was able to convince the market that the announced products carried more top- and bottom-line prospects than already priced in, not only would existing investors sit tight but would probably attract new money. In investors’ eyes, the company did not hit it out of the park.

But why the perceived disappointment? Of the three products announced, Apple Watch and Apple Pay probably carry a lot more weight than the iPhone. They would be the first products under Tim Cook to help us measure if there was any innovation mojo left within the company. The iPhone is a success already, with 300mn to 400mn of them that are over two years old. The upgrade cycle will be huge, we know that. But one cannot just rely on milking winners forever. Already, the iPad, another huge success, has had two consecutive quarters of declines. New products – and successful at that – need to come on line. And they have. But can the baton be passed on to them? The Apple Watch may have all the attractive features – sapphire display, can differentiate between a tap and press, uses NFC, and all that – but in the end it starts at $349. It is more expensive than the new iPhones – two-year contract starts at $199 for the new iPhone 6 (4.7”) and at $299 for the iPhone 6 Plus (5.5”). Besides, one wonders how many of us would like to go back to wearing big, bulky wearable devices on our wrist. If my phone does all that and more, where is the need? Thirdly, the Apple Watch won’t be available until next year and hence would miss the all-important holiday season. As per the other product, it is smart for AAPL to try to get into the mobile payment system. They have 800 credit cards on their iTunes system. Apple Pay is really an extension of the security provided by TouchID, and does not aim to eliminate credit cards rather just be a merchant processor. But is it a game changer? Time will tell. We simply do not know. Hence the in-limbo status for now.

And for investors, particularly the agile ones, this does not give much of a reason not to lock in profit. If the stock does not stabilize soon, that is bound to cause trouble for the overall market. AAPL simply carries too much weight in market cap-weighted indices such as the S&P 500 Index and the Nasdaq Composite, not to mention the Nasdaq 100.