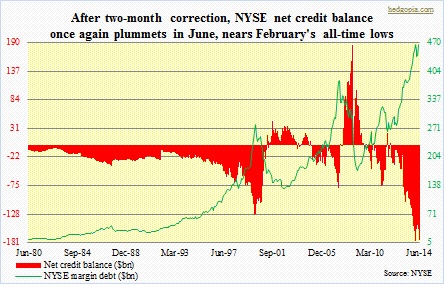

NYSE margin debt shot back up in June, surging 5.9 percent month-over-month to $464.3bn, just a touch below February’s all-time high of $465.7bn. This follows a down March and April and flattish May. In recent months, action on the Nasdaq has been a mirror reflection of the ebbs and flows in margin debt. The tech-heavy index fell in March and April and rose 3.9 percent in June, outrunning the S&P 500 (up 1.9 percent) and the Dow Industrials (up 0.7 percent). If this blogger is forced to hazard a guess, margin debt in July will probably be either flat or down (numbers will be out in a month). The major U.S. indices are barely up for the month – more or less flat. Such has been the reliance of equities on margin debt. The above-mentioned indices are barely a percent away from their highs – either all-time or multi-year – and desperately need new buying power. The much-hoped-for investor exodus from bonds has so far been exactly that – a hope, and in all probability will continue to remain that way. Since the end of 2013, ICI data show, money-market funds have declined by $156bn, to $2.6tn. Disposable personal income has more or less gone sideways the past year and a half, even as average hourly earnings of U.S. private employees grew two percent year-over-year in June – not much to write home about. The point is, there is not much dry powder left. Unless of course margin debt continues to cooperate.

NYSE margin debt shot back up in June, surging 5.9 percent month-over-month to $464.3bn, just a touch below February’s all-time high of $465.7bn. This follows a down March and April and flattish May. In recent months, action on the Nasdaq has been a mirror reflection of the ebbs and flows in margin debt. The tech-heavy index fell in March and April and rose 3.9 percent in June, outrunning the S&P 500 (up 1.9 percent) and the Dow Industrials (up 0.7 percent). If this blogger is forced to hazard a guess, margin debt in July will probably be either flat or down (numbers will be out in a month). The major U.S. indices are barely up for the month – more or less flat. Such has been the reliance of equities on margin debt. The above-mentioned indices are barely a percent away from their highs – either all-time or multi-year – and desperately need new buying power. The much-hoped-for investor exodus from bonds has so far been exactly that – a hope, and in all probability will continue to remain that way. Since the end of 2013, ICI data show, money-market funds have declined by $156bn, to $2.6tn. Disposable personal income has more or less gone sideways the past year and a half, even as average hourly earnings of U.S. private employees grew two percent year-over-year in June – not much to write home about. The point is, there is not much dry powder left. Unless of course margin debt continues to cooperate.

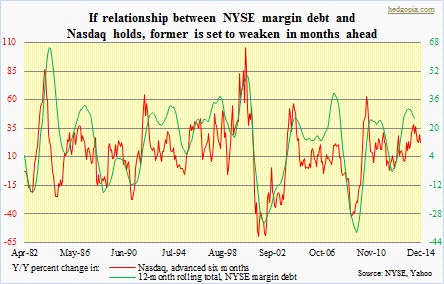

It is worth noting that NYSE margin debt is more of a retail tool. Institutions can deploy other tools in order to take on leverage. There are some signs that the latter is beginning to exit equities even as the former is piling in. Increasingly, institutions are seeking protection in the big names. If this phenomenon bears itself out, then it is just a matter of time before ‘retail’ is left holding the bag. The latter obviously is no match for institutional heft. If institutions are in selling/hold mode, then stocks can only come under pressure. This then will have the potential to compel ‘retail’ into cutting back on leverage. This is where it can get interesting. Assuming the relationship between the Nasdaq and margin debt holds, as the chart above shows, margin debt is set to come under pressure in months ahead. And given how extended this metric is, it can take a life of its own. Already, net credit balance (‘free credit cash accounts’ plus ‘credit balances in margin accounts’ minus ‘debit balances in margin accounts’) is a whopping -$175.8bn, a hair below February’s record of -$177.5bn. Uncharted territory!

It is worth noting that NYSE margin debt is more of a retail tool. Institutions can deploy other tools in order to take on leverage. There are some signs that the latter is beginning to exit equities even as the former is piling in. Increasingly, institutions are seeking protection in the big names. If this phenomenon bears itself out, then it is just a matter of time before ‘retail’ is left holding the bag. The latter obviously is no match for institutional heft. If institutions are in selling/hold mode, then stocks can only come under pressure. This then will have the potential to compel ‘retail’ into cutting back on leverage. This is where it can get interesting. Assuming the relationship between the Nasdaq and margin debt holds, as the chart above shows, margin debt is set to come under pressure in months ahead. And given how extended this metric is, it can take a life of its own. Already, net credit balance (‘free credit cash accounts’ plus ‘credit balances in margin accounts’ minus ‘debit balances in margin accounts’) is a whopping -$175.8bn, a hair below February’s record of -$177.5bn. Uncharted territory!