The euro has been in an incessant rally mode since July 2012, and particularly since July 2013. This has surprised a lot of observers as this has come in the face of what in ordinary circumstances could/should have resulted in a weak/weaker euro – a dovish ECB, an economy that is struggling to come out of deflationary trends, etc.

The euro has been in an incessant rally mode since July 2012, and particularly since July 2013. This has surprised a lot of observers as this has come in the face of what in ordinary circumstances could/should have resulted in a weak/weaker euro – a dovish ECB, an economy that is struggling to come out of deflationary trends, etc.

Nevertheless, unlike the Bank of England, the Bank of Japan and the Federal Reserve, the ECB has yet to fully adopt an unconventional monetary policy such as QE. Investor interest/confidence, particularly in periphery assets, has grown. Credit spreads have tightened. The cost of capital has dropped. Spanish and Italian 10-year yields are at all-time lows. Lower yields surely help strengthen the balance sheets of banks in these countries, which, in turn, could spur lending. Economic indicators in the Zone have improved as well – relatively speaking. All this has probably given investors sufficient reason to load up on euros, and they have.

A strong currency can cut both ways. While on the one hand it reflects rising investor confidence, from the trade perspective, however, it does not help exporters. At the current exchange level, Germany is doing just fine, thanks to a rise in productivity, but for countries in the periphery, exports are not quite as competitive. Italy and France openly blame the strong euro on their economic problems.

The ECB has repeatedly tried to jawbone the currency down, without any success. This is in sharp contrast with what it has been able to achieve on the yield front just by talking – Mario Draghi’s “to do whatever it takes” has gone a long way. It is a tricky balance the ECB needs to maintain. If it announces a further stimulative monetary policy to deal with low inflation, a potentially lower euro can result in investors lock in gains in bonds, hence higher yields.

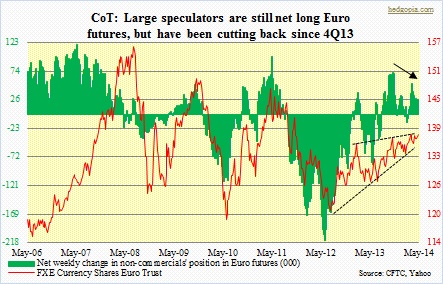

This somewhat confusing scenario is reflected in how non-commercials are currently playing the currency in the futures market. They are still net long, but less and less so since 4Q13. As the chart above shows, the currency, just under 140, is at a crucial level. It remains overbought short-, mid- and long-term. Near-term, the FXE is beginning to act like it wants to go lower. If it manages to take out 140, it likely will be followed by more technical buying, followed by a reversal. Under the right circumstances – for instance, if the ECB announces something – it has potential to head a lot lower.

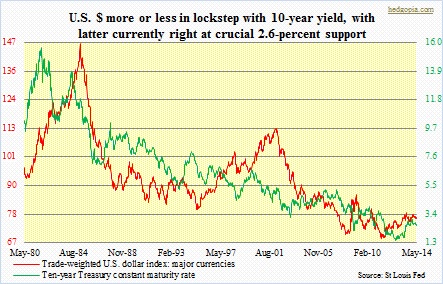

With perhaps one caveat. As does the euro, the 10-year Treasury yield currently sits at a crucial level. If it breaks 2.6 percent, the greenback likely comes under pressure, which then could put upward pressure on the euro. From the medium- to long-term perspective, however, the path of least resistance for the euro is down.