US home prices are through the roof. But homeowners are not rushing to tap their equity. Their balance sheet has improved thanks to all the stimulus money post-pandemic. This creates a nice cushion to fall back on especially when home prices begin to correct.

In 2021, the median price of a US existing home surged 14.7 percent to $354,600, which is just slightly off the record high $362,800 reached last June; January was down 1.2 percent month-over-month to $350,300.

Similarly, the median price of a new home last year increased 8.3 percent to $395,500. Then in January, prices jumped seven percent m/m to $423,300 – within striking distance of the record high $427,300 from last October.

In consequence, homeowners are sitting on tons of equity. In 3Q21, owners’ equity as a percent of household real estate assets stood at 68.8 percent, which represents the highest reading since 1Q88 (4Q21 numbers are due out next Thursday). But they are not rushing to tap that.

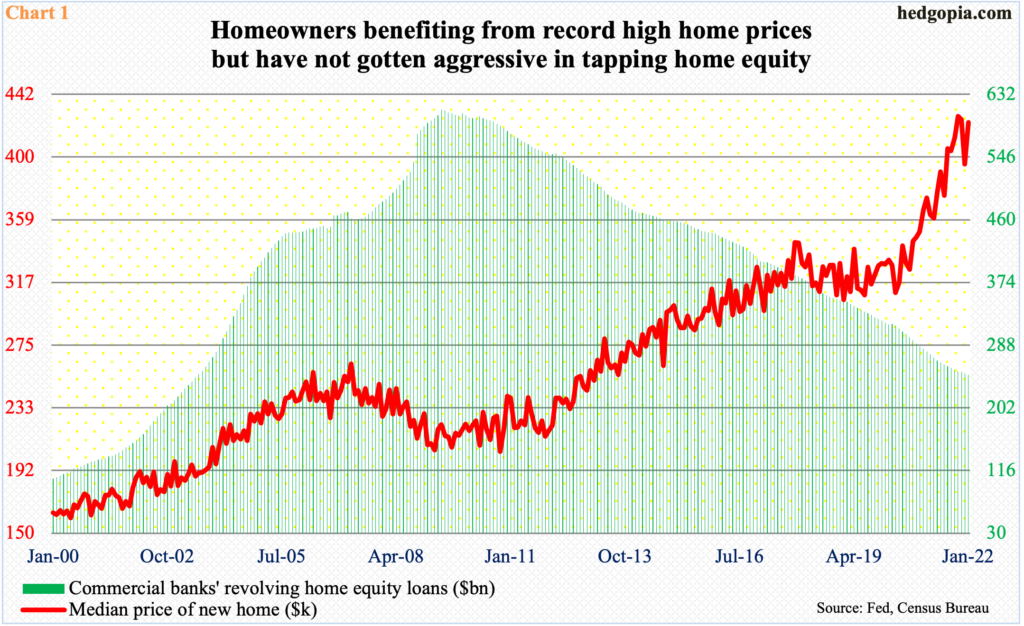

In January, US banks’ revolving home equity loans were $247.6 billion. These loans have not been this low since June 2003 and have been trending lower since peaking in May 2009 at $611.3 billion (Chart 1).

Homeowners’ behavior is so different from the early years of this century when these loans persistently increased and ultimately became a problem when the housing bubble burst. At least from this standpoint, US housing faces minimal risks, although the surge in prices remains a potential thorn in the economy’s side.

One reason why households have not felt the need to tap their home equity is the improvement in their balance sheet. Thanks to all the stimulus handed out to them post-pandemic and the massive recovery in the economy, deposits are surging.

In 4Q21, US banks’ domestic deposits were $18.2 trillion, made up of $12.7 trillion in interest-bearing and $5.4 trillion in non-interest-bearing. They are all at new highs. Deposits began a new leg higher in 1Q20, and the upward trend is intact. This always provides a nice cushion to fall back on, especially as home prices begin to correct, which given the vertical ascent they have experienced in recent years should occur sooner than later.

Thanks for reading!