Investors Intelligence bulls fell further this week, with bears jumping to an eight-plus-year high. The options market, too, shows fear has set in. Odds of a bear market rally have grown.

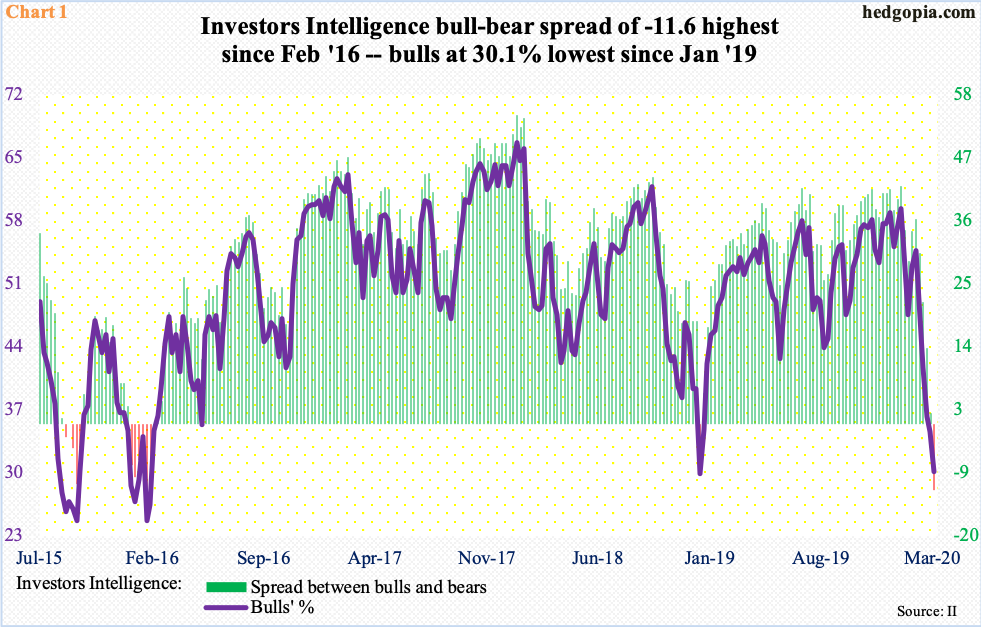

Investors Intelligence bulls further fell this week, down 4.5 percentage points week-over-week to 30.1 percent. This is the lowest since printing 29.9 percent early January last year. Back then, major U.S. equity indices formed a major bottom around Christmas 2018. Bears peaked at 34.6 percent back then. This week, they jumped to 41.7 percent – the highest since October 2011.

As a result, the bull-bear spread fell to minus 11.6 percentage points this week, which was the highest since February 2016 (Chart 1). That marked an important low in stocks as well.

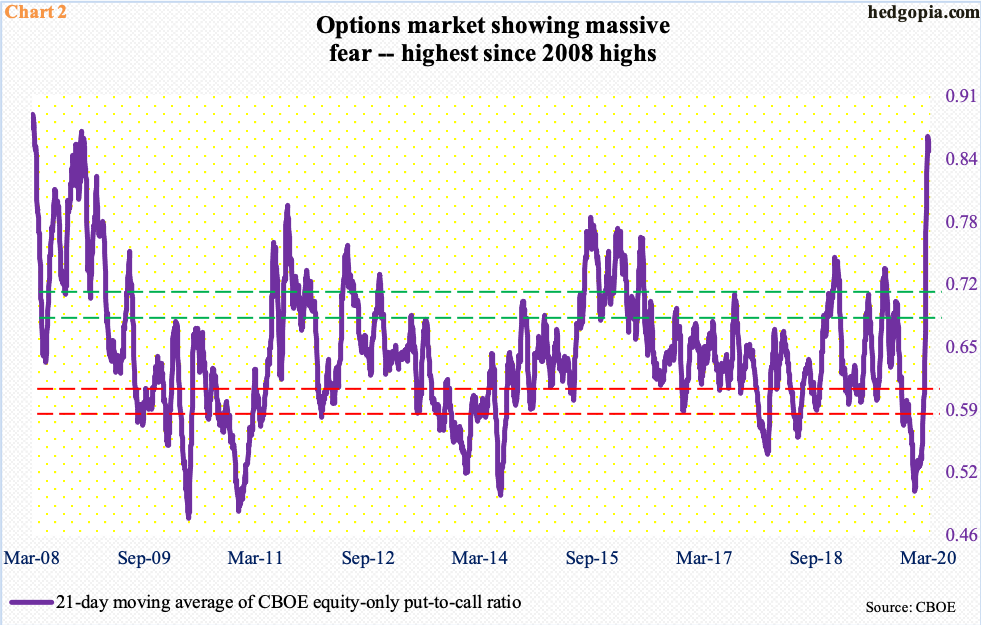

These are readings indicative of massive pessimism. This is also portrayed in the options market.

The 21-day average of the CBOE equity-only put-to-call ratio surged to 0.867 last Friday, before coming under pressure a tad, with Wednesday at 0.852. Last Friday’s reading was the highest since April 2008. Back then, the ratio peaked at 0.890 in March, with persistent readings of 0.70s and 0.80s throughout that year (Chart 2). Obviously, the current panic is nowhere near what was observed back then. This also applies to investor sentiment (Chart 1).

That said, fear has quickly replaced greed. In a month, sentiment has done a quick U-turn. The current readings are elevated enough unwinding can continue, raising odds of a bear market rally in stocks.

Thanks for reading!