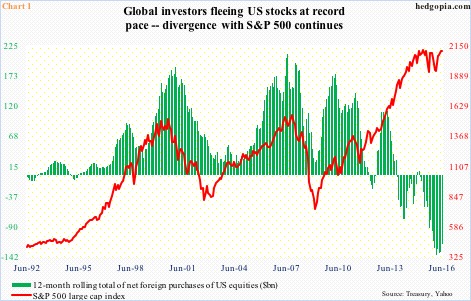

Through June, foreigners continued to bail out of U.S. stocks. They sold $6.8 billion worth. This was the fifth consecutive month of net selling, during which cumulatively they reduced holdings by $45.5 billion.

On a 12-month rolling total basis, April this year saw a record $135.6 billion in net selling by foreigners. This improved to minus $118.7 billion in June, but still represents massive selling (Chart 1).

This is nothing new. Foreigners have been selling for a while.

The Treasury International Capital System data is a little old. Through the all-time high of 2193.81 on Monday this week, the S&P 500 large cap index rallied another 4.5 percent since the end of June. It is possible the green bars in Chart 1 continued to shrink in July and August. We will find out when these numbers are reported. That said, it has been more than three years since these bars began to diverge from the red line. This is more of a medium- to long-term concern.

Near-term, the real story lies elsewhere as far as sources of buying power are concerned.

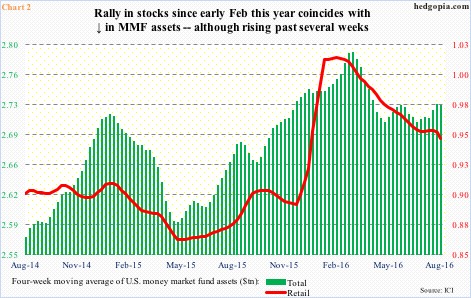

Most recently, money-market fund (MMF) assets peaked at $2.81 trillion in the week ended March 2nd this year, before coming under pressure. Then since July 6th in particular, it slightly rose from $2.7 trillion to $2.71 trillion as of this Wednesday. Last week, it rose to $2.74 trillion.

The uptick in MMF assets in recent weeks is best visible in Chart 2. On a four-week moving average basis, as of August 17th, they have risen from $2.71 trillion to $2.73 trillion in six weeks, although retail funds have continued to drop.

The rally in stocks since February this year coincides with a drop in MMF assets. The recent uptick in the green bars in Chart 2 cannot be equity-friendly. Particularly so when major U.S. indices are sideways and equity funds continue to bleed.

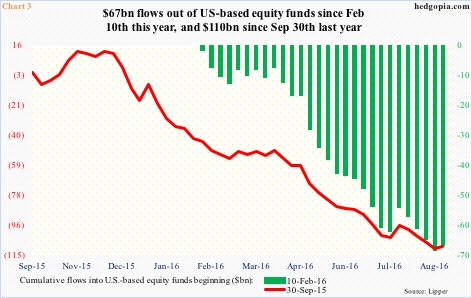

Since the week ended September 30th last year, $110 billion has come out of U.S.-based equity funds. To refresh, the S&P 500 bottomed on the 29th of that month. Later in February this year, the index bottomed on the 11th. Since the week ended February 10th, $67 billion has been withdrawn. The point is, these rallies have been used as an opportunity to lighten up/exit.

With that as a background, the trend in MMF assets raises caution flag.

Thanks for reading!