Dividends are a good source of income for Americans.

Since Great Recession ended, U.S. personal income rose 35 percent to a seasonally adjusted annual rate of $16.4 trillion in 2Q17, while dividend income jumped 72.3 percent to $968.8 billion.

Dividend income goes a long way, particularly considering the subdued interest rate environment.

The Fed left the fed funds rate zero-bound – between zero and 25 basis points – for seven years, until it hiked in December 2015. There have been three more hikes since, for a total of 100 basis points since the first hike. At 1.16 percent, rates are still very accommodative, although the economy is in its ninth year of recovery.

This has suppressed interest income.

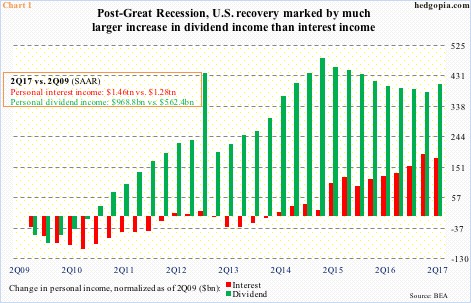

In Chart 1, both interest and dividend income are normalized as of 2Q09. Interest income rose from $1.28 trillion (SAAR) back then to $1.46 trillion in 2Q17 – for a mere increase of 14.1 percent – dividend income from $562.4 billion to $968.8 billion.

That said, dividend income did peak in 1Q15 at $1.05 trillion. As did the share of dividend income in total personal income. In 2Q17, this was 5.9 percent, down from 6.8 percent in 1Q15.

This is also true with S&P 500 companies.

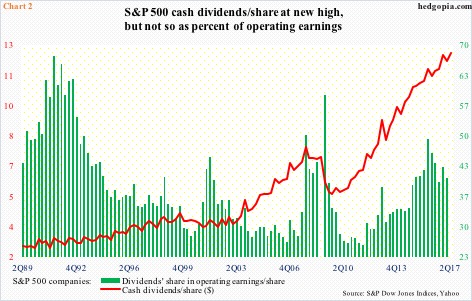

In 1Q17, they paid $100.9 billion in dividends, down from a record $103.8 billion in 4Q16. Similarly, operating earnings were $247.2 billion in 1Q17, after having peaked at $262.9 billion in 3Q14.

Thus, as a share of operating earnings/share, dividends/share peaked at 49.2 percent in 4Q15. It was 40.7 percent in 1Q17, when cash dividends/share was $11.72, against operating earnings/share of $28.82.

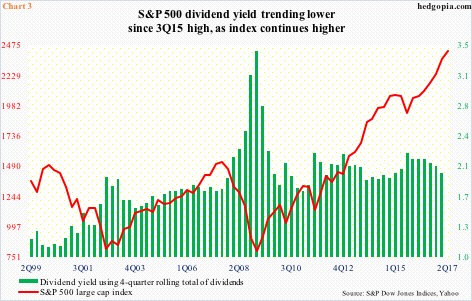

S&P Dow Jones Indices puts 2Q17 dividends/share at $12.12 – a new record. Notice the ascent in the red line in Chart 2 post-Great Recession. This just about mimics how the S&P 500 large cap index has rallied since then (Chart 3).

But because stocks have had such a powerful rally, the dividend yield is essentially flat to slightly down. In 3Q09, the S&P 500 yielded 2.24 percent, just about flat with 2.22 percent in 3Q15, before coming under pressure. In 1Q17, it went sub-two percent, to 1.98 percent (Chart 3).

As things stand, this is unlikely to change, unless stocks come under pressure.

In 2016, S&P 500 companies paid $45.70 in dividends/share. In the first half this year, this was $23.84. Simplistically annualizing it gets us a yield of 1.92 percent currently. At 2.28 percent, 10-year Treasury notes yield more than that.

And that is the problem facing equity investors. Putting new money in at this stage does not earn much yield. Until now, this has been more than made up by total return, thanks to the rally in stocks. But in a bull market that is eight-plus years old, risk-reward is tilted toward the former.

A decent correction can begin anytime.

Thanks for reading! Please share.