- Velocity of money one of two components to determine GDP

- Six years into U.S. economic recovery, velocity remains way suppressed

- Inability of velocity to rise during monetary expansion raises disinflation/deflation risks

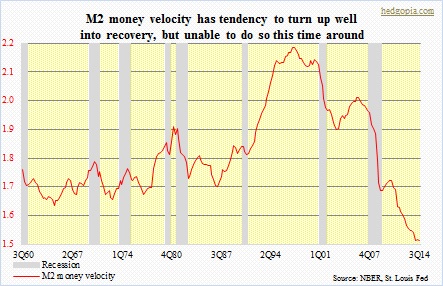

It is troubling how this late into the cycle, the U.S. velocity of money cannot get going. Velocity simply means how many times a unit of currency flows through the economy – from one holder to the next. The red line in the chart below has shown a tendency to shrink during recessions and expand as recoveries take hold. This time around, that has yet to happen. In 2010, velocity did try to hook up, failed and has been pressure ever since. If there is any solace, it is that it has gone sideways the past three quarters.

The equation for GDP is: GDP = money supply x velocity of money. Shows how crucial the latter is. Just a rise in the former (money supply) does not determine the output. Velocity needs to cooperate as well. If it is rising, then transactions are taking place more frequently, and is a way to gauge the economy’s strength or people’s willingness to spend money.

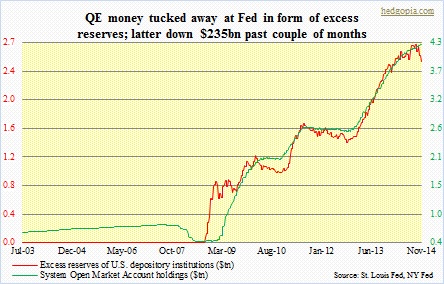

Here is the worrying part. This shrinkage in velocity has come amidst an expansionary monetary policy. Yet another example of how central banks can create liquidity (supply) but has no control over the demand side of the equation. Banks’ excess reserves have ballooned. (They have gone down by over $200bn the past couple of months, though.) Also shows the private sector’s willingness to hoard money. Disinflation/deflation, anyone?