Tick, tick, tick. That is the sound of the clock ticking for the first rate hike by the Fed. It is coming sooner than expected. So it seems. Or, is it? At least that is how the market seems to be readying itself for. We will get some hints this Wednesday. Market participants will be on pins and needles, wondering if the phrase “for a considerable period of time” would be removed from the post-FOMC statement. Regardless, there will be implications across asset classes, more so if the phrase gets taken out. In the currency world, the conventional wisdom runs like this. The US economy is strengthening. And that the Fed is closer than previously thought to hiking rates. Nowhere is this rationale better reflected than the US Dollar Index, which is up six percent since July. Hence the risk of a dollar selloff in the event the Fed decides to maintain the status quo. Indeed, on a short- to medium-term, the greenback is way extended technically. This thing is looking for a reason to sell off, at least in the short-term. Across the Atlantic, the ECB just last week cut its interest rates as well as plans to purchase assets-backed securities. One of the unstated goals is a lower euro. There you have it – a perfect scenario for a strong dollar and a weak euro. And that is exactly how futures traders have been positioning themselves for weeks now, and they continue to.

Tick, tick, tick. That is the sound of the clock ticking for the first rate hike by the Fed. It is coming sooner than expected. So it seems. Or, is it? At least that is how the market seems to be readying itself for. We will get some hints this Wednesday. Market participants will be on pins and needles, wondering if the phrase “for a considerable period of time” would be removed from the post-FOMC statement. Regardless, there will be implications across asset classes, more so if the phrase gets taken out. In the currency world, the conventional wisdom runs like this. The US economy is strengthening. And that the Fed is closer than previously thought to hiking rates. Nowhere is this rationale better reflected than the US Dollar Index, which is up six percent since July. Hence the risk of a dollar selloff in the event the Fed decides to maintain the status quo. Indeed, on a short- to medium-term, the greenback is way extended technically. This thing is looking for a reason to sell off, at least in the short-term. Across the Atlantic, the ECB just last week cut its interest rates as well as plans to purchase assets-backed securities. One of the unstated goals is a lower euro. There you have it – a perfect scenario for a strong dollar and a weak euro. And that is exactly how futures traders have been positioning themselves for weeks now, and they continue to.

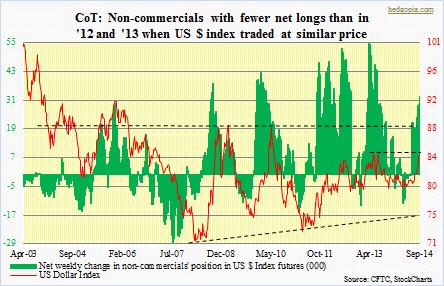

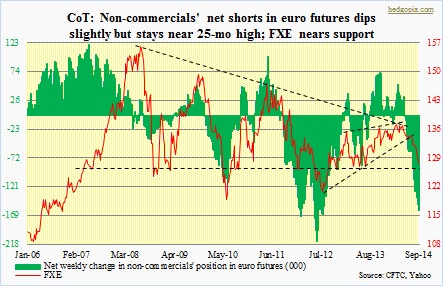

Mid-June this year, non-commercials flipped from net shorts in US $ index futures to net longs, and have maintained that bullish bias ever since. Interestingly, since that time until now, long contracts have doubled to 72k contracts, even as shorts have gone up by 4k to 40k. In other words, shorts have not completely given up. If and when they do, potentially that could amount to more tailwind for the dollar. But for now here is the thing. As can be seen in the chart above, in July of both 2012 and 2013 the index (84.24) was at a comparable level to where it is trading today. But on both those occasions, net longs were much higher. This could be viewed as either (a) the level of conviction among traders is much less this time around (dollar negative) or (b) trader sentiment is yet to get to effervescent levels (dollar positive). In the latter scenario, the index probably finds its way toward 88. Monthly technical indicators do indeed have room to continue to rise before conditions get overbought. Before that happens, the index needs to get over 85. In the midst of all this, the euro is trying to find some footing. Last week, buyers did step in at/near 127 on the FXE (127.65), but conviction is lacking. Not surprising given the six-month, eight-percent shellacking the ETF suffered beginning March. Too soon to say it is major, but the potential is there. Wait-and-see for now. Last week, bulls and bears played to a draw – always a positive after a sharp drop. Dollar weakness at this juncture would definitely help, which means the afore-mentioned 85 resistance holds. The likely catalyst is the FOMC meeting. Even more so would be trader reaction, regardless what the statement says.

Mid-June this year, non-commercials flipped from net shorts in US $ index futures to net longs, and have maintained that bullish bias ever since. Interestingly, since that time until now, long contracts have doubled to 72k contracts, even as shorts have gone up by 4k to 40k. In other words, shorts have not completely given up. If and when they do, potentially that could amount to more tailwind for the dollar. But for now here is the thing. As can be seen in the chart above, in July of both 2012 and 2013 the index (84.24) was at a comparable level to where it is trading today. But on both those occasions, net longs were much higher. This could be viewed as either (a) the level of conviction among traders is much less this time around (dollar negative) or (b) trader sentiment is yet to get to effervescent levels (dollar positive). In the latter scenario, the index probably finds its way toward 88. Monthly technical indicators do indeed have room to continue to rise before conditions get overbought. Before that happens, the index needs to get over 85. In the midst of all this, the euro is trying to find some footing. Last week, buyers did step in at/near 127 on the FXE (127.65), but conviction is lacking. Not surprising given the six-month, eight-percent shellacking the ETF suffered beginning March. Too soon to say it is major, but the potential is there. Wait-and-see for now. Last week, bulls and bears played to a draw – always a positive after a sharp drop. Dollar weakness at this juncture would definitely help, which means the afore-mentioned 85 resistance holds. The likely catalyst is the FOMC meeting. Even more so would be trader reaction, regardless what the statement says.