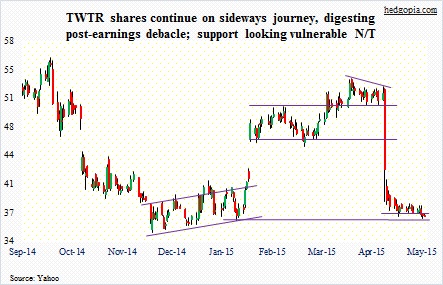

Twitter (TWTR) closed at $36.60 on Friday. Sellers of May 22nd 37 cash-secured puts are now long the stock, which was discussed on the May 19th post (here). The $0.39 premium earned makes it an effective long at $36.61.

What next?

Here are a few options.

1. Stay put. The stock has taken a 29-percent pounding in the wake of 1Q15 earnings. Management was not able to forecast monthly average users (MAUs) – at 302 million in 1Q, up 18 percent year-over-year. This, among others, really spooked the analyst community.

Numbers have been cut left and right. Since 1Q earnings, June-quarter estimates have gone down from $0.07 to $0.04, September-quarter from $0.08 to $0.06, 2015 from $0.38 to $0.34, and 2016 from $0.80 to $0.67.

Not unexpectedly, the sell-side did not waste a second in bringing out the scalpel. From last month, there are three fewer buy’s/strong buy’s – 16 versus 19 – and three more hold’s, at 23. Sell’s have gone from two to one.

So it is fair to assume that the worst is probably behind us until at least the June quarter is announced. The bar has been lowered. In fact, in just last week June-quarter estimates have gone down by a penny. It used to be $0.05; now it is $0.04.

Viewed from this perspective, TWTR is a hold.

In ideal circumstances, the stock should gradually begin to rise into June-quarter earnings. If the company fails to deliver for the second consecutive quarter, then lots of hitherto-optimists will begin to leave. Already, management not giving out MAU guidance has provided fodder to worrywarts who fear the company is struggling to gain traction in attracting new users, and by default advertisers. But it is equally possible the company delivers in the June quarter, proving the March quarter was nothing more than a stumble.

2. Sell the stock. The combined volume on April 28-29 was nearly 200 million. TWTR trades at a three-month average of 20 million shares. Investors who bailed out post-earnings are not going to get back in anytime soon. The stock rose as high as just under $75 on Boxing Day 2013, less than two months after its IPO. The only other time it has traded below the current price was in May-June and December of 2014. There is no shortage of investors who are either sitting on losses or who post-1Q earnings exited with losses.

For technically-oriented, as things stand now, it is a broken stock. Once an asset drops like this, base-building can take a long time for another sustained move higher.

So why bother? Why hold this thing and have capital tied up? Just sell, and move on to something else. Fair argument.

3. Deploy options. Do a covered call. There are two ways to do this. One, sell an in-the-money weekly call, let us say May 29th 36 for $0.93. The idea here is to have the stock possibly called away, which ensures $0.32 profit. If it does not get called away, the effective cost drops to $35.68. Two, sell an out-of-the-money May 29th 37 call for $0.39. If called away, it nets $0.78. If it is not called away, the effective cost drops to $36.22. The risk in both is that there is no downside protection. Option (two) is riskier if the intention is to have it called away.

TWTR has gone sideways for 16 sessions now. Last week, it came very close to losing that support. Shares are still above the May 6th low of $36.52. The daily MACD is progressively moving higher. So a spike is always possible. In fact, we saw one last Wednesday; the stock shot up to $37.94 intra-day before giving back the gains and then some. With that said, the best course of action for now is probably to have it called away. At least try to, by selling the 36 call. The effective cost will have dropped quite a bit if it does not get called away.

Thanks for reading!