Major U.S. equity indices have rallied massively – particularly since the lows of December 2018. Throughout this, money-market funds kept rising. In recent weeks, they have dropped a tad. If this is the beginning of a trend, bulls will be giving each other high fives.

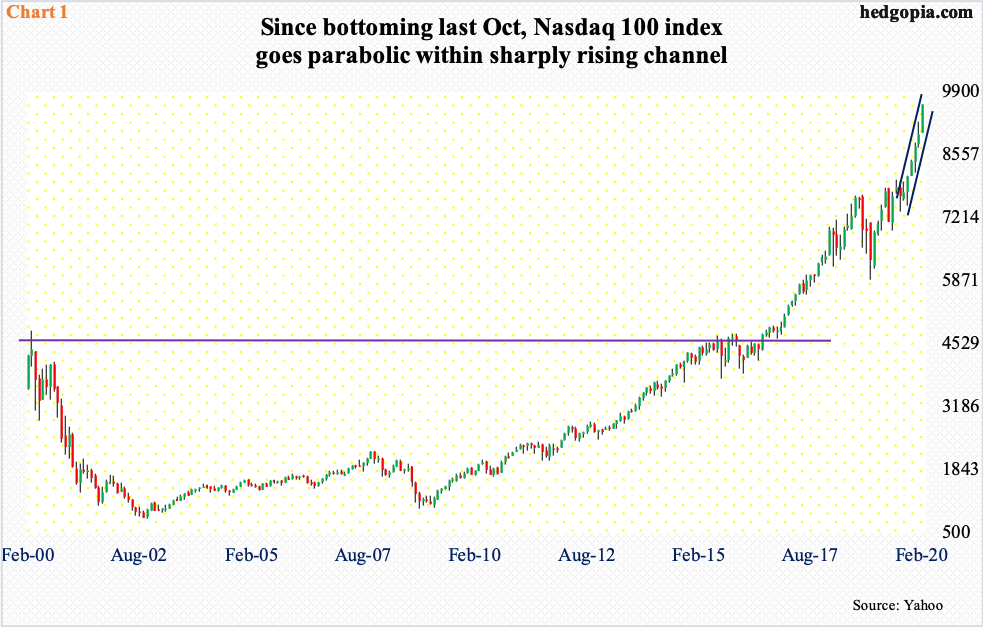

Bulls are running riot. Nowhere is this more evident in the U.S. stock market than on the Nasdaq 100, which is outrunning all other major U.S. equity indices, such as the S&P 500 large cap index and the Dow Industrials.

Year-to-date, the Nasdaq 100 is already up north of 10 percent. Just since last October, it is up nearly 29 percent and up 63 percent since December 2018! The move since October in particular has been nothing short of parabolic, trading all along a sharply rising ascending channel (Chart 1). It is currently hitting the upper bound.

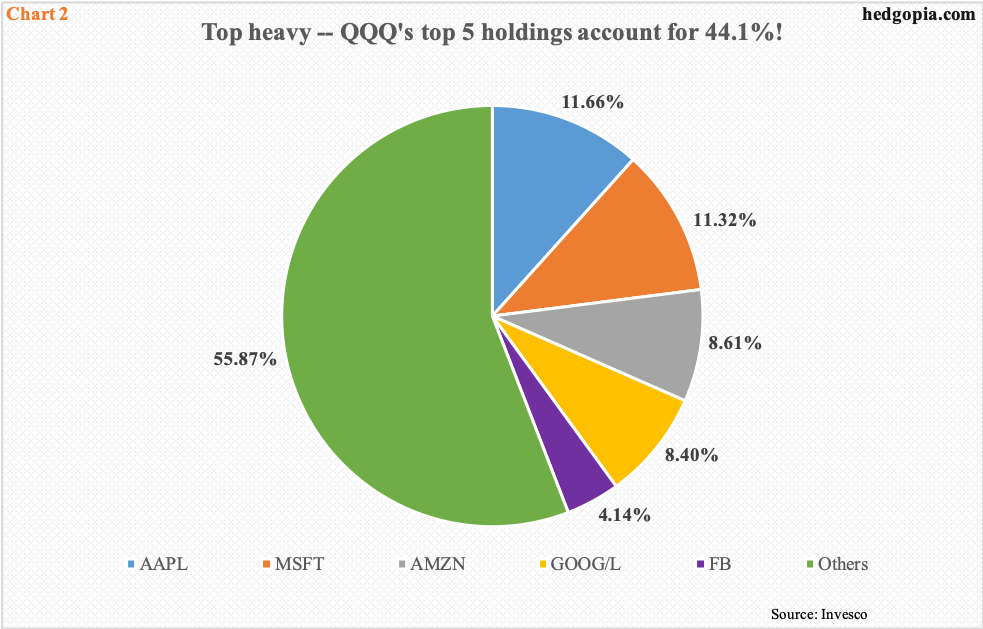

The rally is top-heavy.

Chart 2 shows the top five holdings of QQQ (Invesco QQQ Trust ETF), and they absolutely dominate, with Apple (AAPL) accounting for 11.7 percent, Microsoft (MSFT) 11.3 percent, Amazon (AMZN) 8.6 percent, Alphabet (GOOG/L) 8.4 percent and Facebook (FB) 4.1 percent. The top two alone account for 23 percent of the Nasdaq 100! This is too lop-sided – and risky when things reverse, particularly considering the gains they have had.

From the lows of December 2018, AAPL is up 129 percent and MSFT 97 percent, while AMZN is up 63 percent, GOOG 57 percent and FB 74 percent.

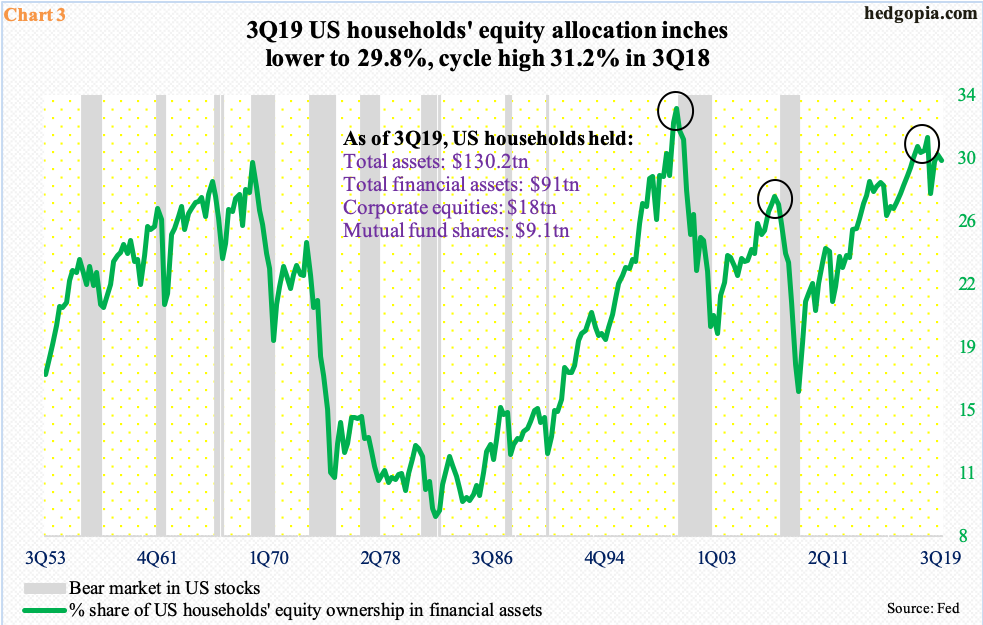

Not surprisingly, several valuation metrics are in nosebleed territory. One such is highlighted in Chart 3, which shows U.S. households’ equity allocation. At 3Q19, it dropped four-tenths of a percentage point sequentially to 29.8 percent. The cycle high 31.2 percent was reached in 3Q18, which is already higher than last cycle’s peak of 27.7 percent set in 2Q17. The all-time high of 32.9 percent was hit in 1Q00; back then, stocks peaked early March.

Fourth-quarter numbers will be out next month. It is possible the metric rose last quarter. U.S. stocks rallied big during the quarter. The S&P 500 jumped 8.5 percent and the Nasdaq 100 12.7 percent. The momentum has continued this quarter. From this perspective, bulls are probably gunning for the 1Q00 high as far as equity allocation goes. There is at least one scenario in which this is doable.

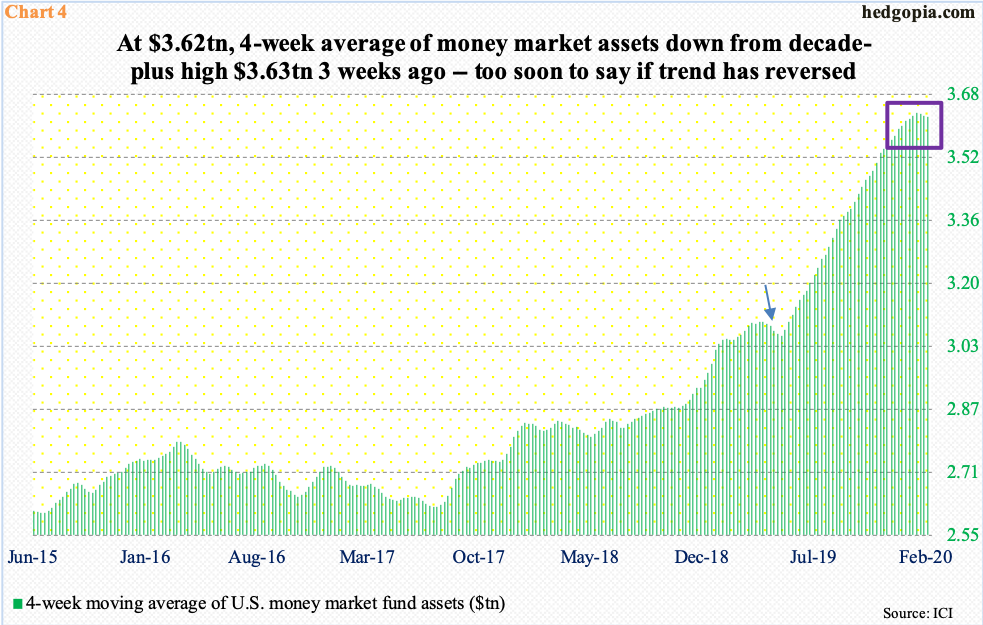

As of last Wednesday, there was $3.63 trillion sitting in U.S. money-market assets. This is slightly down from $3.64 trillion five weeks ago. Accordingly, the four-week average was $3.62 trillion last week, down from $3.63 trillion three weeks ago. The recent drop is highlighted by the box in Chart 4. This preceded massive accumulation, particularly since May last year (arrow).

Interestingly, these assets grew even as stocks were rallying hard. Hence bulls’ hope of a trend reversal. The question is, is the mouth-watering rally particularly since December 2018 finally tempting those on the sidelines into jumping on the bullish bandwagon?

Last year, after peaking late March, the four-week average fell for six weeks in April and May before the uptrend reasserted itself mid-May. Things could very well evolve similarly. If instead the recent decline in the green bars is indeed the beginning of contraction in these funds, this will be music to bulls’ ears, as at least some of this money should find a home in equities.

This can also be seen through how deposit dynamics are playing out at U.S. banks. As of 3Q19, they held $13 trillion in domestic deposits, of which $9.8 trillion was interest-bearing and $3.1 trillion non-interest-bearing.

Interest-bearing deposits are at a new high, while non-interest-bearing reached its highest in 4Q17 at $3.2 trillion. Non-interest-bearing deposits – consisting of both commercial and retail customers – can of course flow to rate-paying accounts, which possibly happened over the last several quarters. But it is equally possible they get invested in other assets, including equities. Prevailing interest rates are nothing to write home about, and retail customers in particular can get tempted by the rip-roaring rally in stocks. As things stand, this is the best thing that could happen to equity bulls right here and now.

Thanks for reading!