For U.S. corporations, there was a trio of bad news in yesterday’s revised productivity numbers for the first quarter, and this potentially has earnings repercussions.

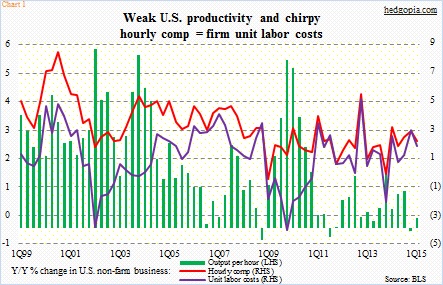

U.S. non-farm business output per hour year-over-year was revised lower from growth of 0.6 percent to 0.3 percent (Chart 1). Productivity has been faring poorly in recent quarters. Quarter-over-quarter, it has declined in the past two quarters, with 1Q15 revised from negative 1.9 percent to negative 3.2 percent.

Growth in hourly comp, in the meantime, was revised higher y/y for both 4Q14 and 1Q15 – from 2.5 percent to 2.9 percent and from 1.7 percent to 2.1 percent respectively. As a result, increase in unit labor costs y/y was revised higher from 2.6 percent to three percent and from 1.1 percent to 1.8 percent, in that order. Q/Q, they shot up 5.5 percent in 4Q14 and 6.5 percent in 1Q, revised higher from prior 4.1 percent and five percent respectively.

Unit labor costs are a function of hourly comp and output per hour. If expressed in percent change, they are equal to hourly comp minus output per hour. Lower productivity combined with higher comp is not a good recipe as far as corporate profits are concerned.

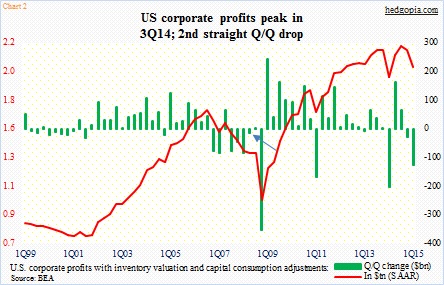

And it is beginning to show up in numbers. U.S. corporate profits (with inventory valuation and capital consumption adjustments) were $2 trillion (seasonally adjusted annual rate) in 1Q15, and have been down sequentially in the past two quarters. They peaked at $2.17 trillion in 3Q14. This was the first back-to-back decline since 2Q08 (blue arrow in Chart 2).

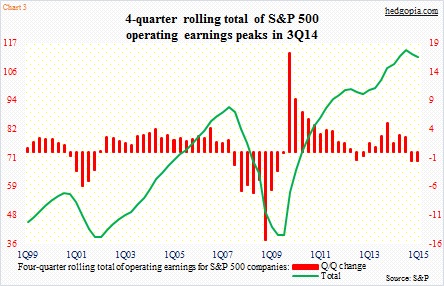

If we focus on bottom-up operating-earnings expectations for S&P 500 companies this year, they are currently $116, and have been persistently trending lower since particularly the beginning of the year. If consensus expectations are met, earnings would have grown 2.7 percent this year – clear deceleration from growth of 5.3 percent in 2014 and 10.8 percent in 2013. Incidentally, the four-quarter rolling average of earnings also peaked in 3Q14, at $114.51, which by 1Q15 had fallen by $3 (Chart 3).

And this! Of the $116 expected this year, 2H expectations are high. Earnings are expected to decline 2.6 percent in 2Q15, followed by a steep rise in the remaining two quarters – up 1.3 percent in 3Q and up 18.4 percent in 4Q.

For this to materialize, metrics in Chart 1 need to improve. The trend is not going the right direction.

Thanks for reading!