- Fed has openly discussed benefits of wealth effect; now adds another tool – talking down dollar

- Six years into recovery post-crisis, U.S. economy yet to witness escape velocity

- Dovish FOMC message fails to ignite sustained rally in US equities

These are confusing times. Markets are having difficulty making heads or tails – reflected in the roller-coaster moves of late. Early last month, a San Francisco Fed paper argued that “the public seems to expect a more accommodative policy than Federal Open Market Committee participants,” implying that markets expect the Fed to start raising rates later than would be anticipated. In other words, the paper suggested that based on projections of FOMC members, rates next year were likely to rise sooner than what was priced in at the time. It turns out, markets were right. We learned in the FOMC minutes the other day that members were concerned about a surging dollar and a weakening global economy. The tone was much more dovish than expected. Translation: The Fed likely will wait longer to raise short-term rates than currently priced in. Yields on five-year treasury notes fell more than six basis points on Wednesday post-FOMC minutes.

These are confusing times. Markets are having difficulty making heads or tails – reflected in the roller-coaster moves of late. Early last month, a San Francisco Fed paper argued that “the public seems to expect a more accommodative policy than Federal Open Market Committee participants,” implying that markets expect the Fed to start raising rates later than would be anticipated. In other words, the paper suggested that based on projections of FOMC members, rates next year were likely to rise sooner than what was priced in at the time. It turns out, markets were right. We learned in the FOMC minutes the other day that members were concerned about a surging dollar and a weakening global economy. The tone was much more dovish than expected. Translation: The Fed likely will wait longer to raise short-term rates than currently priced in. Yields on five-year treasury notes fell more than six basis points on Wednesday post-FOMC minutes.

This blog has been consistently contending that things are not as hunky-dory as optimists would have us believe. Japan is stuck in a rut, despite Abenomics and all. The euro zone has lost whatever momentum it briefly experienced. China has slowed down from its torrid pace of growth, with risk rising deceleration might accelerate. Everywhere we look, debt is a problem, and it is worse than pre-financial crisis.

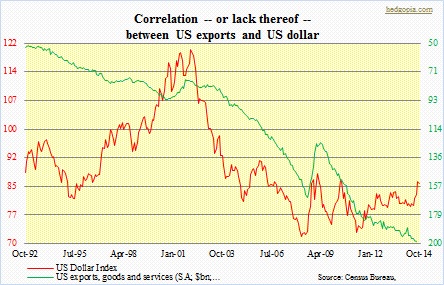

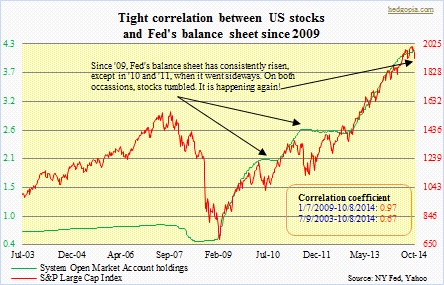

In some ways, the FOMC minutes were a shocker. It was as if the Fed was admitting that there was not much room left for organic economic growth. Which is exactly what has happened in the euro zone and Japan. And reason why both those nations have resorted to using their respective currencies as a tool. Now the Fed is onto the same game – gradually trying to talk the dollar down. Less than three weeks ago, in a CNBC interview, Bill Dudley, New York Fed president, expressed concern over the greenback’s recent strength. “If the dollar would strengthen a lot that would have consequences for growth.” You get the point. They would like a lower dollar. The minutes yesterday carried the same message; the Fed staff were forced to cut their growth outlook due to the higher dollar. A lower currency could not only help buoy exports but also push up inflation. As a debtor nation, you would want to see the latter. The problem is, when the major economies are all trying to weaken their respective currencies, in the end it might just be a wash. As far as the Fed is concerned, their tool box has contained of conventional short-term rates and the unconventional QE. ‘Talking down the dollar’ is another arrow in their quiver. Previously, Ben Bernanke admitted in a 60 Minutes interview back in 2010 that the wealth effect was a tool and that higher stock prices would have a positive impact on the economy. Since 2009, stocks have been highly correlated with the Fed’s assets.

In some ways, the FOMC minutes were a shocker. It was as if the Fed was admitting that there was not much room left for organic economic growth. Which is exactly what has happened in the euro zone and Japan. And reason why both those nations have resorted to using their respective currencies as a tool. Now the Fed is onto the same game – gradually trying to talk the dollar down. Less than three weeks ago, in a CNBC interview, Bill Dudley, New York Fed president, expressed concern over the greenback’s recent strength. “If the dollar would strengthen a lot that would have consequences for growth.” You get the point. They would like a lower dollar. The minutes yesterday carried the same message; the Fed staff were forced to cut their growth outlook due to the higher dollar. A lower currency could not only help buoy exports but also push up inflation. As a debtor nation, you would want to see the latter. The problem is, when the major economies are all trying to weaken their respective currencies, in the end it might just be a wash. As far as the Fed is concerned, their tool box has contained of conventional short-term rates and the unconventional QE. ‘Talking down the dollar’ is another arrow in their quiver. Previously, Ben Bernanke admitted in a 60 Minutes interview back in 2010 that the wealth effect was a tool and that higher stock prices would have a positive impact on the economy. Since 2009, stocks have been highly correlated with the Fed’s assets.

The problem with this is two-fold. First, this drives markets nuts. One moment, they are told the currency is not a policy tool. The next moment, it sounds like someone is trying to talk it down. Second, the Fed runs a risk of losing effectiveness. In May 2013, post-taper talk, rates shot up. On Wednesday, they went down. This is an example of markets paying close attention to the Fed and adjusting accordingly. At the same time, we now have this. Equities responded to Wednesday’s dovish Fed message by a huge rally. But yesterday, those gains were all given back, and then some. In the past, a rally in the wake of a dovish message has persisted for a while. This is a slight change in market reaction, but could end up being a big tell. We will find out in due course.