“Greed, for lack of a better word, is good.” So says the fictional character Gordon Gekko in the 1987 film Wall Street.

Then there is the saying ‘bulls make money, bears make money, pigs get slaughtered.’

The hypothetical buy-write involving XLE, the SPDR Energy ETF, initiated two weeks ago is proof that greed can exact a price.

To refresh, on December 23rd, XLE was purchased for $59.54, against which December 31st 60.50 calls were simultaneously sold for $0.57. Since these calls were not exercised (on December 31st, the ETF closed at $60.32), the cost of the long position effectively dropped to $58.97.

A week ago, longs had three options: (1) close the position for a profit of $1.35, (2) continue to hold, or (3) try to further lower the cost using options. A covered call was deployed, in which January 8th 59.50 calls were sold for $1.49. The effective cost dropped to $57.48.

On both Monday and Tuesday last week, the covered-call decision looked good. XLE was north of $59.50 – on course for assignment, for a profit of $2.02. Then in the next three sessions, the bottom fell out, with the ETF dropping 7.4 percent, closing the week at $56.05 (Chart 1).

Pig got slaughtered. Gordon was wrong.

Hindsight is always 20/20, but there is truth to the saying ‘a bird at hand is worth two in the bush.’ The trade swung from a potential profit of $1.35 to a loss of $1.43.

When the covered call was done a week ago, the idea was to either have it called away or go long near support. Obviously it did not quite work out that way.

Spot West Texas Intermediate crude broke down – again – dropping out of a bear flag (Chart 2). What looked like an imminent bullish 10/20 crossover (daily moving average) failed to complete, with the crude making an intra-day low on Thursday of $32.10/barrel, matching the low of December 2003.

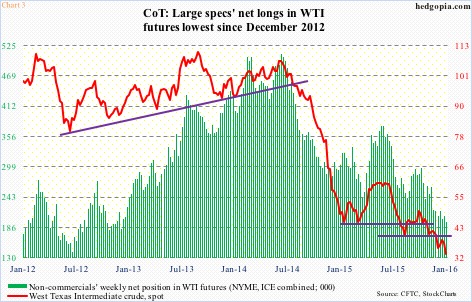

Non-commercials continue to cut back net longs in West Texas Intermediate crude futures. As of last Tuesday, they held 196,250 contracts (both NYME and ICE) – the lowest since December 2012 (Chart 3). These traders have a penchant for where oil is headed… or it may be the other way around, with the crude leading. Either way, the green bars need to move up for oil to move up.

Non-commercials continue to cut back net longs in West Texas Intermediate crude futures. As of last Tuesday, they held 196,250 contracts (both NYME and ICE) – the lowest since December 2012 (Chart 3). These traders have a penchant for where oil is headed… or it may be the other way around, with the crude leading. Either way, the green bars need to move up for oil to move up.

Until that happens, one can argue the best course of action is to stay out of the crude’s way. In the above example, then, cut the loss and move on. That is one way to deal with it.

Then there are technicals. Not that they are beginning to lean bullish. They are not. Not yet anyway. Shorter-term moving averages are again pointing lower.

At the same time, the daily chart is looking grossly oversold.

At this point in time, rather than expecting the crude to rally, the goal should probably be damage repair. Of fear and greed, the trade is driven by a little bit of the former.

In this context, January 15th 56.50 calls bring $0.96. If called away, long XLE gets sold for $57.46, for a loss of $0.02 overall. Else, the effective cost drops to $56.52.

Thanks for reading!