Back on June 1st, I talked about a naked call strategy on XLY, the Consumer Discretionary SPDR ETF. To refresh, the ETF closed at 76.52 then. Weekly June 5th 76.50 calls were sold for $0.47. Last Friday, XLY closed at $76.52.

The OCC’s (Options Clearing Corporation) threshold for auto assignment is $0.01 in the money. XLY was $0.02 in the money when the option expired.

The short call gets assigned, creating an effective short at $76.97.

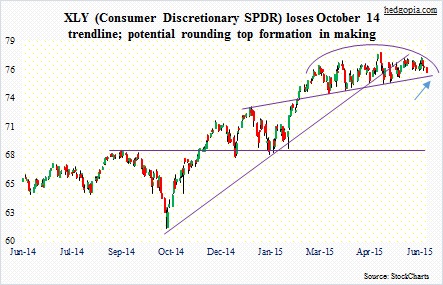

Yesterday, XLY closed at $75.98, taking out its 50-day moving average. Daily momentum indicators still seem to want to go lower. Ditto with weekly conditions. The ETF is approaching trendline support going back to December last year (blue arrow in chart), which also approximates the lower Bollinger Band. So we will see what happens here.

Intermediate-term, there is probably more downside ahead.

Retail sales for May will be reported this Thursday, and can influence how XLY trades, particularly that day. Of late, retail sales have lost momentum – down month-over-month in four of the last five months. Year-over-year, growth has been decelerating since last August – from growth of five percent to 0.9-percent increase in April.

Thanks for reading!

Please keep in mind that this article was originally published earlier today by See It Market, where I am a contributor.