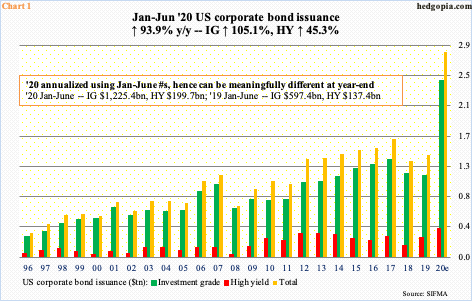

Already-levered US corporations are levering up even more. The first half this year already matched issuance of last year. This is taking place even as corporate debt is at record high, with several metrics well into extended territory.

Momentum in US corporate bond issuance continued in June. A total of $235.4 billion, made up of $177.6 billion in investment-grade (IG) and $57.8 billion in high-yield (HY) was issued. This brings the six-month total to $1.43 trillion – $1.23 trillion in IG and $199.7 billion in HY. This already matched the issuance in all of last year.

If momentum continues in the remaining six months, issuance is on course for $2.85 trillion, which will have surpassed the 2017 record $1.64 trillion by a mile; both IG and HY will have made fresh highs (Chart 1).

In all probability, the Fed provided the impetus behind the issuance this year. On March 23rd, it announced it would buy IG corporate bonds, which was expanded to include HY on April 9th. This created an implied backstop for investors, even as corporations are taking advantage of low rates. From the week to April 15th through Wednesday this week, Lipper data show, high-yield funds attracted $35.2 billion.

The aggression in issuance is coming at a time when corporations are already in neck deep in debt.

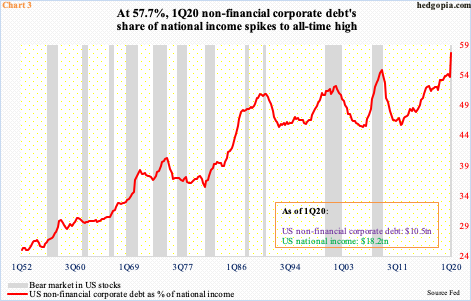

In 1Q20, non-financial corporate debt jumped $600.3 billion quarter-over-quarter to $10.5 trillion – a new record. Momentum has been in place for a while, which is evident in Chart 2 which uses a four-quarter average.

More importantly, the level of corporate debt is beginning to look extreme on several fronts, one of which is highlighted in Chart 3, which plots corporate debt as a percent of national income. In 1Q20, it surged to a fresh high 57.7 percent.

Nothing says the red line in the chart cannot continue higher, as it has defied expectations for a while now. But with each push higher, the risk of a reversal grows.

Thanks for reading!